National Payments Corporation of India (NPCI)

1001A, B wing, 10th Floor, The Capital, Bandra-Kurla Complex, Bandra (East), Mumbai - 400 051. Maharashtra. India.

The relevant jurisdiction for NPCI is India. NPCI in the past has entered into network-to-network agreements with international networks. Such agreements define the rights and obligations of the international network partner and NPCI and is agreed and signed by the respective international network partner. After the formation of its subsidiary, NPCI International Payments Limited (NIPL), now such contracts with network partners are entered into by NIPL.

Reserve Bank of India (RBI)

The date of this disclosure is March 31,2023.

This disclosure can also be found at https://www.npci.org.in/who-we-are/risk-management/risk-management-npci.

I. Executive summary

II. Summary of major changes since the last update of the disclosure

III. General background on the FMI

IV. Principle-by-principle summary narrative disclosure

V. List of publicly available resources

Financial market infrastructures (FMIs) that facilitate the clearing, settlement and recording of monetary and other financial transactions can strengthen the markets they serve and play a critical role in fostering financial stability. However, if not properly managed, they can pose significant risks to the financial system and be a potential source of contagion, particularly in periods of market stress. FMIs play a critical role in the financial system and the broader economy. In April 2012, the Committee on Payment and Settlement Systems (CPSS) and Technical Committee of the International Organization of Securities Commission (IOSCO) published the report “Principles for Financial Market Infrastructures (PFMI)”, which establishes new international standards for payment systems that are systemically important, central securities depositories, securities settlement systems, central counterparties and trade repositories.

NPCI is a technology Company that connects financial institutions (including banks), merchants, digital partners, businesses and other organizations, enabling them to use electronic forms of payment. Through its core payments processing network, NPCI also facilitates the switching (authorization, clearing and settlement) of payment transactions and delivers related products and services for its customers.

NPCI’s customers are mostly financial and other institutions and typically does not have any contractual agreements directly with end consumers.

NPCI has completed Principles for Financial Market Infrastructure (PFMI) assessment for financial year 2022-23.

Nil

General description of the FMI and the markets it serves.

National Payments Corporation of India (NPCI), an umbrella organization for operating retail payments and settlement systems in India, is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007, for creating a robust Payment & Settlement Infrastructure in India.

NPCI was incorporated as a “Not for Profit” Company under the provisions of Section 25 of the Companies Act 1956 (now Section 8 of the Companies Act 2013), with an intention to provide infrastructure to the entire banking system in India for electronic payment and settlement systems. NPCI’s focus is on bringing innovations and widening the reach of retail payment system by using technology that will enable greater efficiency in operations.

General organization of the FMI

NPCI was incorporated as a "Not for profit" company under the provision of section 25 of the Companies Act 1956 (now Section 8 of the Companies Act 2013). NPCI is owned by PSU banks, Private Sector banks, co-operative banks, Regional Rural banks, small finance banks. The oversight of governance of NPCI is vested with the Board of Directors. Board Committees of NPCI are as below:

The above Committees oversee different functions of NPCI with overall supervision of the Board. Under the overall supervision and control of the Board, the Managing Director & Chief Executive Officer (MD & CEO) looks after the day-to-day functions of the company. The MD & CEO is supported by Chief Financial Officer, Chief Operating Officer, Chief Risk Officer and various other senior officials.

Legal and regulatory framework

NPCI, pursuant to the Authorization received from the RBI, is engaged in operating retail payment systems in India.

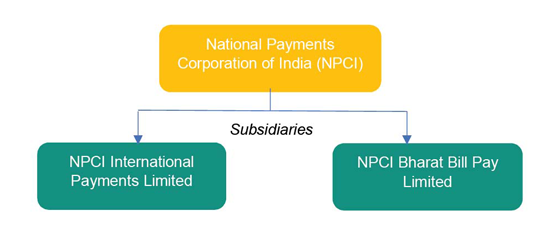

NPCI was incorporated as a “Not for Profit” company under Section 25 of the Companies Act 1956 (now Section 8 of the Companies Act 2013). A new entity, NPCI International Payments Ltd (NIPL) was incorporated under the Companies Act, 2013, as a wholly-owned subsidiary of NPCI, for the purpose of entering into business arrangements with foreign networks for implementation of NPCI’s products in foreign jurisdictions. Similarly, NPCI Bharat Bill Pay Limited (NBBL) was incorporated under the Companies Act, 2013 as a wholly-owned subsidiary of NPCI and the Bharat Bill Payment System (BBPS) business was transferred by NPCI to NBBL.

The Payment and Settlement Systems Act, 2007(hereinafter referred to as the “PSS Act”) designates RBI as the nodal agency for the regulation and supervision of payment systems in India. NPCI and NBBL are Authorized by RBI to operate retail payment systems in India under the PSS Act. Pursuant to this Authorization, NPCI and NBBL are carrying out their respective business operations within the territorial jurisdiction of India. NIPL has been authorized by RBI to enter into agreements with international networks and other entities for enabling implementation of NPCI products in foreign jurisdictions. Accordingly, NIPL carries out its operations within and outside the territories of India.

With respect to jurisdiction mapping, the exclusive jurisdiction of the courts at Mumbai, India is preferred for all product agreements executed by NPCI.

The general applicability of principles to specific type of FMIs are specified in the Principles for Financial Market Infrastructures (PFMI). Accordingly, not all 24 principles are relevant for NPCI.

| Principle | Name | Applicable to Payment Systems | Applicable to NPCI | Reason |

|---|---|---|---|---|

| 1 | Legal Basis | Yes | Yes | |

| 2 | Governance | Yes | Yes | |

| 3 | Framework for the comprehensive management of risks | Yes | Yes | |

| 4 | Credit Risk | Yes | Yes | |

| 5 | Collateral | Yes | No | NPCI collects the cash collateral from participants for the purpose of SGF. NPCI does not collect collateral for its exposure to participants. |

| 6 | Margin | No | No | |

| 7 | Liquidity Risk | Yes | Yes | |

| 8 | Settlement Finality | Yes | Yes | |

| 9 | Money Settlement | Yes | Yes | |

| 10 | Physical Deliveries | No | No | |

| 11 | Central Security Depositories | No | No | |

| 12 | Exchange of value settlement system | Yes | No | This principle applies only to FMIs that settle transactions which involve two linked obligations. |

| 13 | Participant Default Rules and Procedures | Yes | Yes | |

| 14 | Segregation and Portability | No | No | |

| 15 | General Business Risk | Yes | Yes | |

| 16 | Custody and Investment Risk | Yes | Yes | |

| 17 | Operational Risk | Yes | Yes | |

| 18 | Access and Participation Requirement | Yes | Yes | |

| 19 | Tiered participation arrangements | Yes | Yes | |

| 20 | FMI Links | No | No | |

| 21 | Efficiency and Effectiveness | Yes | Yes | |

| 22 | Communication procedures and standards | Yes | Yes | |

| 23 | Disclosure of rules, procedures and market Data | Yes | Yes | |

| 24 | Disclosure of market data by trade repositories | No | No |

| Principle | Approach to observing the principle |

|---|---|

Principle 1: Legal Basis An FMI should have a well-founded, clear, transparent, and enforceable legal basis for each material aspect of its activities in all relevant jurisdictions. |

NPCI has received Authorization from RBI under section 4 of Payment and Settlement Systems Act, 2007 for carrying out payment services in India. With respect to jurisdiction mapping, the exclusive jurisdiction of the Courts at Mumbai, India is preferred in all product agreements executed by NPCI. NPCI, in the past, had entered into network-to- network agreements with few international partners. After incorporation of NIPL, all such agreements have been/ are being novated to NIPL. Going forward, NIPL will be entering into these international alliances with network partners. |

Principle 2: Governance An FMI should have governance arrangements that are clear and transparent, promote the safety and efficiency of the FMI, and support the stability of the broader financial system, other relevant public interest considerations, and the objectives of relevant stakeholders. |

NPCI has governance arrangements which emphasize on safety and efficiency, support financial stability and other relevant public interest considerations. NPCI has been incorporated as "Not for Profit" organization under the provision of section 25 of the Companies Act, 1956 (now section 8 of the Companies Act, 2013). Roles and responsibilities of Board of directors is defined in NPCI's Corporate Governance handbook which also includes vision, mission, values and structure. |

Principle 3: Framework for the comprehensive management of risks An FMI should have a sound risk-management framework for comprehensively managing legal, credit, liquidity, operational, and other risks. |

NPCI has Enterprise Risk Management Framework, Operational Risk Management Framework, Third Party Risk Management Policy, Investment Policy, Information Security and Settlement Guarantee Mechanism Policy that applies to NPCI and its wholly owned subsidiaries. All risk management policies are reviewed and approved by Board annually. |

Principle 4: Credit Risk An FMI should effectively measure, monitor, and manage its credit exposures to participants and those arising from its payment, clearing, and settlement processes. |

NPCI has established Settlement Guarantee Mechanism (SGM) framework to measure, monitor and manage its credit exposures to participants and those arising from its settlement process. As part of SGM, NPCI has created a settlement guarantee fund (SGF) to ensure availability of liquidity to meet settlement obligations. |

Principle 7: Liquidity Risk An FMI should effectively measure, monitor, and manage its liquidity risk. An FMI should maintain sufficient liquid resources in all relevant currencies to effect same-day and, where appropriate, intraday, and multiday settlement of payment obligations with a high degree of confidence under a wide range of potential stress scenarios that should include, but not be limited to, the default of the participant and its affiliates that would generate the largest aggregate liquidity obligation for the FMI in extreme but plausible market conditions. |

NPCI has constituted a Settlement Guarantee Mechanism comprising collaterals and line of credit arrangements to address any impact of liquidity risk which may be caused by temporary/permanent defaults by a member participant. |

Principle 8: Settlement finality An FMI should provide clear and certain final settlement, at a minimum by the end of the value date. Where necessary or preferable, an FMI should provide final settlement intraday or in real time. |

NPCI operates Deferred Net Settlement system on batch processing. Rules are set out that unsettled payments cannot be revoked by participants. NPCI has put in place mechanism to ensure that final settlement is achieved on the value date. |

Principle 9: Money Settlement An FMI should conduct its money settlements in central bank money where practical and available. If central bank money is not used, an FMI should minimize and strictly control the credit and liquidity risk arising from the use of commercial bank money. |

NPCI conducts its money settlement in RTGS account maintained by participant members with RBI. In the case of international alliance, prefunding amount in required to be maintained in commercial banks in India. NPCI has put in place a process to ensure that banks with highest creditworthiness and competence are accepted for such prefunding arrangements. A separate SGF amount is also maintained by such alliance partners with NPCI. Prefunding account is being monitored on daily basis. |

Principle 13: Participant-default rules and procedures An FMI should have effective and clearly defined rules and procedures to manage a participant default. These rules and procedures should be designed to ensure that the FMI can take timely action to contain losses and liquidity pressures and continue to meet its obligations. |

NPCI has defined rules and procedures for participant default in Settlement Guarantee Mechanism (SGM) policy and Standard Operating Procedure (SOP). Policy / SOP covers maintenance of Settlement Guarantee Fund and Loss Sharing Mechanism. |

Principle 15: General business risk An FMI should identify, monitor, and manage its general business risk and hold sufficient liquid net assets funded by equity to cover potential general business losses so that it can continue operations and services as a going concern if those losses materialize. Further, liquid net assets should always be sufficient to ensure a recovery or orderly wind-down of critical operations and services. |

NPCI identifies, monitors, and manages its general business risk through risk management policies and procedures. NPCI holds sufficient liquid net assets funded by equity to cover potential general business losses so that it can continue operations and services. NPCI has a Board approved “Orderly Wind-Down Document’’. |

Principle 16: Custody and investment risks An FMI should safeguard its own and its participants’ assets and minimize the risk of loss on and delay in access to these assets. An FMI’s investments should be in instruments with minimal credit, market, and liquidity risks. |

NPCI’s Investment Policy defines investment instruments, exposure limits, etc. The details of new and existing investments are reviewed and evaluated by Investment Committee every quarter. |

Principle 17: Operational risk An FMI should identify the plausible sources of operational risk, both internal and external, and mitigate their impact using appropriate systems, policies, procedures, and controls. Systems should be designed to ensure a high degree of security and operational reliability and should have adequate, scalable capacity. Business continuity management should aim for timely recovery of operations and fulfilment of the FMI’s obligations, including in the event of a wide-scale or major disruption. |

NPCI has an Operational Risk Management policy and SOP to identify, measure, analyze, evaluate, mitigate, monitor and report operational risks resulting from both internal and external factors. NPCI has business continuity management for timely recovery of operations and fulfilment of obligations. |

Principle 18: Access and participation requirements An FMI should have objective, risk-based, and publicly disclosed criteria for participation, which permit fair and open access. |

NPCI has defined the criteria and requirements to participate as sponsor/member bank or sub-member bank in Procedural Guidelines (PG). PG includes different parameters like operational, financial and legal eligibility. Eligible entities have fair and open access to all the services. NPCI has fair and non-discriminatory access and participation criteria. |

Principle 19: Tiered participation arrangements An FMI should identify, monitor, and manage the material risks to the FMI arising from tiered participation arrangements. |

To ensure larger participation by banks and other financial institutions, NPCI has established process to allow indirect participation as sub-member through sponsor banks so as to mitigate material risks arising from such tiered participation arrangement. |

Principle 21: Efficiency and effectiveness An FMI should be efficient and effective in meeting the requirements of its participants and the markets it serves. |

NPCI has formed Steering Committees for all its products. Steering committees ensure that the products and services offered meet the requirements of the participants and the market it serves. NPCI has established operational and performance parameters which are monitored regularly. |

Principle 22: Communication procedures and standards An FMI should use, or at a minimum accommodate, relevant internationally accepted communication procedures and standards to facilitate efficient payment, clearing, settlement, and recording. |

NPCI uses internationally accepted guidelines for EMVCo. Specifications and ISO 8583 messaging protocols and standards. XML or JSON or ISO messaging protocols used for interfacing over secure TCP/IP network are chosen as online and back-office communication standards to facilitate efficient payment, clearing, settlement and recording. |

Principle 23: Disclosure of rules, key procedures, and market data An FMI should have clear and comprehensive rules and procedures and should provide sufficient information to enable participants to have an accurate understanding of the risks, fees, and other material costs they incur by participating in the FMI. All relevant rules and key procedures should be publicly disclosed. |

NPCI's rules and procedures are covered in Procedural Guidelines (PG) and in Operating and Settlement Guidelines (OSG). NPCI share these guidelines with the participants during onboarding and subsequently in case of any modification / change. NPCI discloses member performance, abridged steering committee meeting minutes, other statistics, circulars, products/services brief, list of participants, etc. on its official website. |

NPCI Website: NPCI - National Payments Corporation of India - Official Website

Board of Directors: Board of Directors | NPCI - National Payments Corporation of India

https://www.npci.org.in/who-we-are/board-of-directors

Management Team: Management Team | NPCI - National Payments Corporation of India

https://www.npci.org.in/who-we-are/management-team

Risk Management: Risk Management @ NPCI | NPCI - National Payments Corporation of India

https://www.npci.org.in/who-we-are/risk-management/risk-management-npci

System Statistics: Statistics of NPCI - National Payments Corporation of India

https://www.npci.org.in/statistics

Principles for Financial Market Infrastructures (PFMI):

https://www.bis.org/cpmi/publ/d101a.pdf

Summary of NPCI’s alignment to the applicable Principles are detailed below:

NPCI is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) for creating a robust Payment & Settlement Infrastructure in India. NPCI has been Authorized by RBI for operating retail payments and settlement systems in India under the provisions of the Payment and Settlement Systems Act, 2007 (PSS Act).

Considering the utility nature of the objective of NPCI, it has been incorporated as a “Not for Profit” Company under the provisions of Section 25 of the Companies Act 1956 (now Section 8 of the Companies Act 2013), to provide infrastructure to the entire banking eco system in India electronic payment and settlement systems. NPCI is focused on bringing innovations to the retail payment systems through introduction of new technology for achieving greater efficiency in operations and widening the reach of payment systems.

NPCI’s mission is to touch every Indian with one or other payment services. NPCI’s vision is to be the best payment network Globally.

NPCI has created a robust payments and settlement infrastructure in the country. NPCI has changed the way payments are made in India through bouquet of retail payment products.

NPCI is focused on bringing innovations in the retail payment systems through the use of technology and is relentlessly working to transform India into a digital economy. NPCI is facilitating secure payments solution with nationwide accessibility in furtherance of India’s aspiration to be a fully digital society.

NPCI Group Structure

NPCI International Payments Ltd. (NIPL) has been incorporated with an objective of partnering with foreign entities for implementing various NPCI products including RuPay card scheme and UPI outside India.

NPCI Bharat Bill Pay Limited (NBBL) is a one stop solution for variety of payments, such as, electricity, telecom, DTH, gas, water bills, etc. and other repetitive payments like insurance premium, mutual funds, school fees, institution fees, credit cards, fastag recharge, local taxes, housing society payments, etc.

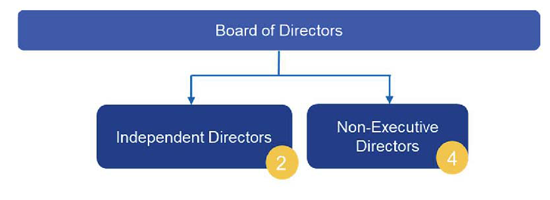

NPCI Board

The Board of Directors of NPCI provides oversight of the strategy and governance to support management in achieving its strategic and business objectives. The Board of NPCI comprise of Independent Directors, RBI Nominee Director, Nominee Directors representing Promoter Banks and Nominee Directors representing Shareholders’ Banks and the MD & CEO.

The Board has delegated the authority to management to design and implement practices and governance that support the achievement of strategies and business objectives through constitution of sub-committees, framing policies and delegation of financial power.

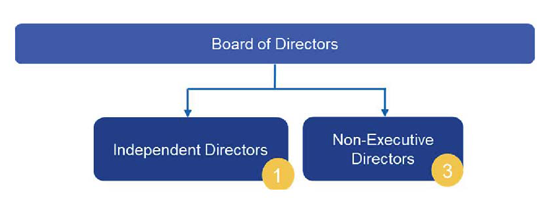

Structure of NPCI Group Board and its committees is exhibited below:

NIPL

NBBL

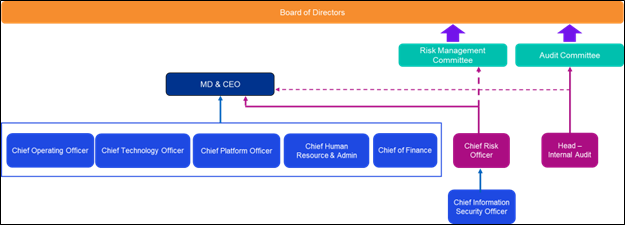

NPCI follows the Three Lines of Defence (LOD) which constitutes Business/Operation functions (first LOD), Risk Management function (second LOD) and Assurance (third LOD). This is structured as under:

Additionally, NPCI’s reporting lines demonstrate segregation of Business/Operation, Risk and Audit Functions. All the business functions have functional reporting to MD & CEO.

The Risk Management function has an additional direct reporting to the Risk Management Committee of the Board. This ensures sufficient independence, authority, resources and access to the Board that enables operations of NPCI to be consistent with the risk-management framework.

Audit Function is independent of management functions. Head of Internal Audit reports functionally to Audit Committee of the Board.

The minutes of the Board Meetings of the NPCI subsidiary companies along with the details of significant transactions and arrangements entered into by the subsidiary companies are reported to the Board on a quarterly basis. The financial statements of the subsidiary companies are presented to the Audit Committee and Board.

In terms of Section 139 (5) of the Companies Act, 2013, Statutory Auditor for NPCI & Subsidiary Companies are appointed by CAG. This appointment is done every year. Additionally, CAG conducts Supplementary audit of NPCI and Subsidiary Companies every year. CAG also conducts Annual Compliance audit.

An FMI should have a well-founded, clear, transparent, and enforceable legal basis for each material aspect of its activities in all relevant jurisdictions.

Key Consideration 1: The legal basis should provide a high degree of certainty for each material aspect of an FMI’s activities in all relevant jurisdictions.

Material aspects that require high degree of legal certainty for NPCI are as follows:

The legal base to above material aspects is provided by The Payment and Settlement Systems Act, 2007.

The relevant jurisdiction for NPCI is India. NPCI in the past has entered into network-to-network agreements with international networks. Such agreements define the rights and obligations of the international network partner and NPCI. After the formation of its subsidiary, NIPL, now such contracts with network partners are entered into by NIPL.

Section 23 of PSS Act, 2007, states that payment or settlement obligations shall be determined in accordance with the gross or netting procedure, as the case may be, approved by the RBI while issuing the Authorization. The SGM Policy states that NPCI performs deferred multilateral net settlement which gets the legal backing from the PSS Act, 2007.

The settlement is considered final and irrevocable as soon as such settlement amount is arrived at through netting procedure. The legal base to above material aspects is provided by The Payment and Settlement Systems Act, 2007.

NPCI has been incorporated as a Not-for-Profit organization under Section 25 of the Companies Act 1956 (now Section 8 of the Companies Act 2013). NPCI has defined Bye laws in the form of Memorandum and Articles of Association which states object clause of NPCI, and other significant activities required for running an organization.

NPCI through its subsidiary NPCI International Payments Limited (NIPL) executed network-to-network arrangements to carry out operations in different jurisdictions. Participant agreement for all products is governed by Indian law and therefore are enforceable in the courts of law of India including arbitration tribunals.

Key Consideration 2: An FMI should have rules, procedures, and contracts that are clear, understandable, and consistent with relevant laws and regulations.

Under Section 3 of the PSS Act, RBI is the designated authority for the regulation and supervision of payment systems. Under section 10 of the PSS Act, RBI is authorized to prescribe standards to be complied by the payment systems. NPCI is a payment system company, authorized by RBI. NPCI’s legal framework is clear, understandable, and consistent with the provisions of the PSS Act and the standards prescribed by RBI.

NPCI's legal framework consists of contracts executed with member participants, networks and vendors; other on-boarding documents and procedure guidelines. These documents cover all material aspects of NPCI operations. NPCI has executed agreement with each and every participant. These agreements are in line with the PSS Act, 2007. Additionally, NPCI has documented Settlement Guarantee Mechanism (SGM) and procedural guidelines that states and clearly articulates the operational aspects with respect to rules and procedures.

NPCI undertakes periodic review of its procedural guidelines and incorporates changes as may be necessary to align it with the standards prescribed by RBI. Any change in the procedural guidelines is communicated to the member participants before implementation to ensure that it is understood by the member participants well in advance before the changes are actually implemented. Training sessions are conducted from time to time for member participants to ensure that the member participants have sufficient understanding of NPCI’s products, operating rules and procedures. NPCI also issues circulars, as and when necessary, to inform member participants on various changes in its product or operations. These circulars are part of the rules and regulations of NPCI to be adhered to by member participants.

On a need basis, depending on complexity / criticality of the matter, documents are referred to external legal consultants for their inputs and opinions.

NPCI's legal framework consists of contracts executed with member participants, networks and vendors; other on-boarding documents and procedure guidelines. These documents cover all material aspects of NPCI operations. Such documents for each product / each tie up are drafted in-house in consultation with and approved by all the relevant internal stakeholders. In the course of these discussions, inputs from all internal stakeholders are appropriately incorporated in the draft document thereby ensuring consistency with relevant laws and regulations. NPCI discusses these documents, as well as alterations to existing ones with members in formal forums such as product steering committee meetings, task force meetings etc.

Key Consideration 3: An FMI should be able to articulate the legal basis for its activities to relevant authorities, participants, and, where relevant, participants’ customers, in a clear and understandable way.

Under Section 3 of the PSS Act, RBI is the designated authority for the regulation and supervision of payment systems. Under section 10 of the PSS Act, RBI is authorized to prescribe standards to be complied by the payment systems. NPCI is a Payment System, authorized by RBI. NPCI functions within the above legal and regulatory framework.

The legal basis for activities of NPCI are further articulated in the agreements and other legal documents executed by NPCI with its member participants and in its procedural guidelines. Procedural guidelines are shared with the participants, and product details are published on NPCI’s website for access to public.

Key Consideration 4: An FMI should have rules, procedures, and contracts that are enforceable in all relevant jurisdictions. There should be a high degree of certainty that actions taken by the FMI under such rules and procedures will not be voided, reversed, or subject to stays.

With respect to rules, procedures and contracts that are enforceable in the local jurisdiction i.e. India, there is a high degree of certainty that its actions will not be voided or reversed in any way as the regulatory framework governing NPCI operations provides certainty to its activities.

In case of contracts entered into with a counterparty incorporated in a jurisdiction other than India (hereinafter referred to as “Foreign Party”), NPCI prefer Indian law, courts/arbitration and jurisdiction in such contracts to ensure certainty that the same are not voided or reversed and are enforceable. Further, NPCI includes appropriate provisions with respect to choice of law and dispute resolution in its agreements to ensure enforceability of the agreement in India and other foreign jurisdictions.

Further, on a need basis, depending on complexity / criticality of the matter, rules, procedures and contracts, are referred to law firms for their inputs and opinions to ensure that the rules, procedures and contracts are valid, effective and enforceable in the relevant jurisdiction. Based on the above grounds, NPCI has a high degree of confidence that the relevant rules, procedures and contracts are enforceable in all relevant jurisdictions.

NPCI has a well-founded, clear, transparent, and enforceable legal basis for each material aspect of its activities in all relevant jurisdictions. Therefore, there is a high degree of certainty that its actions will not be voided, reversed or subject to stays in any way.

The agreements executed by NPCI with its member participants and the procedural guidelines which address the material aspects of payment system operations, including eligibility criteria for on-boarding new member participants, responsibilities and liabilities of member participants, fees and charges, suspension or termination of existing members, enforceability of netting, clearing and settlement procedure, default management procedure (in case of settlement default by any participating member), etc. are binding and enforceable and articulate a clear and enforceable legal basis for securing contractual certainty.

Further, NPCI includes appropriate provisions with respect to the choice of law and dispute resolution in its agreements to ensure enforceability of the agreement in India and other foreign jurisdictions. On a need basis, NPCI seeks opinion from law firms so as to strengthen NPCI’s ability to enforce such agreement.

No such cases where a court in any relevant jurisdiction ever held any of the FMI’s relevant activities or arrangements under its rules and procedural to be unenforceable.

Key Consideration 5: An FMI conducting business in multiple jurisdictions should identify and mitigate the risks arising from any potential conflict of laws across jurisdictions.

NPCI conducts its business primarily in India and therefore, the legal risk to NPCI arising from conflicts of laws is limited. In cases where NPCI enters into agreement with a Foreign Party, NPCI endeavors to mitigate any legal risk arising from conflict of law by opting for common law as the governing law of the agreement (Indian law is also based on common law).

This risk is further alleviated by performing a due-diligence to ensure that the Foreign Party’s home country is a signatory to the New York Convention, 1958 which provides a uniform international framework for dispute resolution to the parties to international commercial agreements and enables the recognition and enforcement of arbitration awards made in other contracting states. Such arbitration awards are binding and enforceable as per the said treaty. Considering arbitration awards passed in countries who have acceded to New York Convention are enforceable in other countries who have also acceded to the said treaty, either Indian arbitration or neutral international arbitration is preferred for dispute resolution mechanism to ensure enforceability of the award in India and other foreign jurisdictions. Accordingly, NPCI includes appropriate provisions with respect to choice of law and dispute resolution in its agreements with Foreign Party and if necessary, NPCI seeks opinion from law firms with respect to NPCI’s ability to enforce such agreement under the Foreign Party’s home jurisdiction.

An FMI should have governance arrangements that are clear and transparent, promote the safety and efficiency of the FMI, and support the stability of the broader financial system, other relevant public interest considerations, and the objectives of relevant stakeholders.

Key Consideration 1: An FMI should have objectives that place a high priority on the safety and efficiency of the FMI and explicitly support financial stability and other relevant public interest considerations.

NPCI has been established for creating a robust payments and settlement infrastructure in India. NPCI’s vision is to become the best global payment network, excelling in its capabilities and services. NPCI is focused on bringing innovations in the retail payment systems through the use of technology for achieving greater efficiency in operations and widening the reach of payment systems.

NPCI’s strategies are aligned to its objectives and the performance is monitored and reviewed regularly so as to ensure meeting the objectives.

Safety and efficiency are given highest importance set to achieve objectives of NPCI. Standard operating procedures are defined for every process to ensure standardization and consistency.

As part of ERM, NPCI has defined comprehensive Key Risk Indicators (KRIs) with thresholds that enables monitoring of operational and financial performance. These KRIs are monitored, and results are presented to Risk Management Committee and the Board at regular frequency. Risk Management policies are placed before the RMC and the Board as part of the annual review process.

Safety is also ensured by the well-formulated IT Infrastructure complemented by the Information Security Framework. NPCI is compliant to ISO standards such as ISO 27001:2013 - Information Security Management System (ISMS), Privacy Information Management System (PIMS) and PCI DSS v4.0.

Key Consideration 2: An FMI should have documented governance arrangements that provide clear and direct lines of responsibility and accountability. These arrangements should be disclosed to owners, relevant authorities, participants, and, at a more general level, the public.

The Committees constituted by the Board plays a crucial role in the governance structure of NPCI and have been constituted to deal with specific areas / activities as mandated by applicable laws/ regulations and requires regular review. The Board Committees are set up under the formal approval of the Board to carry out clearly defined roles which are performed by Members of the Board, as a part of good governance practice.

The Committees of the Board are listed below:

The Board has authorized the MD & CEO to carry out day-to-day affairs of the Company. The MD & CEO is assisted by a strong team of experienced professionals (functional heads) such as COO, CPO, CTO, CRO, CFO, CISO and others. Functional heads are supported by middle level and other officials to carry out day to day operations of NPCI. The Terms of Reference (TOR) of each of the Board committees is available on NPCI website.

Additionally, NPCI has set up the following committees where external experts help in providing guidance to Management team:

The TOR of various committees define duties and responsibilities of the respective committee(s). Management roles, responsibilities and accountability are defined in the function specific policies.

Duties, roles, responsibilities and accountability are documented in TOR and relevant policies. The TOR and other relevant policies are reviewed regularly.

NPCI undertakes accountability towards its shareholders through the Board of NPCI. NPCI seeks approval and provides updates to the Board with respect to business, financials, and other functions. Further, NPCI conducts Annual General Meeting and provides its shareholders the annual financial statements and updates various developments in respect of NPCI’s operations and in certain cases seek necessary approvals that are required in accordance with the Companies Act, 2013.

NPCI enters into contracts with all participants and has well defined procedural and operational guidelines for each of its products. These documents describe roles, responsibility, liability and accountability of NPCI and the participants. Further, the Product Steering Committee has been formed for respective products for product development, product management, roadmap, regulatory compliance and obtain feedback and to address concerns and challenges.

Key function of the NBBL’s Steering Committee is to advise on development and overseeing of the implementation of standards for the bill payment system., through a participative decision-making process.

The annual report of NPCI is shared with shareholders, RBI, and CAG. The annual report provides a complete view of NPCI’s objectives, initiatives taken to achieve those objectives, Financial Results, and other achievements during the year. NPCI complies with periodic submission of regulatory fillings/returns and other statutory requirements.

NPCI publishes annual report to RBI, Shareholders, and Comptroller and Auditor General of India (CAG). Annual Report contains comprehensive information such as Governance Arrangements, Roles and Responsibilities of Board of Directors, Powers delegated to MD & CEO, Code of conduct for Directors, Board Evaluations, Statutory Reports, Financial Statements, etc.

Governance arrangements are disclosed to the public through the company’s website. NPCI discloses the following information on its website:

Key Consideration 3: The roles and responsibilities of an FMI’s board of directors (or equivalent) should be clearly specified, and there should be documented procedures for its functioning, including procedures to identify, address, and manage member conflicts of interest. The board should review both its overall performance and the performance of its individual board members regularly.

The role of the Board is to provide guidance, supervise and control the functioning of the Company.

Role of the Board of Directors as defined in Handbook on Corporate Governance includes:

NPCI has established robust procedures for the functioning of its Board, which includes effective measures to identify, address, and manage conflicts of interest among its members. These procedures are documented in the "Handbook on Corporate Governance for Directors," which serves as a comprehensive guide outlining the processes and principles that govern the Board's functioning.

To ensure transparency and accountability, each director and key managerial personnel is required to provide a declaration to the Board Secretariat department regarding any related party transactions involving themselves or their relatives. This declaration is a vital step in identifying and addressing potential conflicts of interest within the Board.

The "Code of Conduct for Directors," which is part of the Handbook on Corporate Governance for Directors, further details the ethical standards and expectations from the Board members. This code of conduct is publicly available on NPCI's website, accessible to stakeholders and the public, providing clarity on the ethical standards governing the Board's actions.

In the case of independent directors, determination of independence is made on a case-to-case basis, considering all relevant facts and circumstances. Independent directors are required to provide a declaration confirming their independence at the first board meeting they attend and subsequently, at the first meeting of each financial year. This periodic reaffirmation ensures that their independence remains intact.

NPCI's procedures for board functioning, conflict of interest management and related party disclosures are comprehensive, transparent, and are reviewed periodically. These measures uphold corporate governance standards, foster ethical conduct and ensure that the interests of stakeholders are safeguarded.

NPCI has the following Board level committees.

These committees oversee different functions of NPCI with overall supervision of the Board of Directors. Roles and responsibilities, composition, quorum, secretary, authority and review of each committee has been documented in respective Committee’s TOR and corporate governance handbook.

Pursuant to the provisions of the Companies Act, 2013, the Board carries an annual performance evaluation of the Board, its committees, Individual Directors, including Chairman of the Board, MD & CEO. Committee reviews the “evaluation questionnaire(s)” for effective evaluation of performance of the Board and its Committees and individual Directors.

The process of annual evaluation of the Chairman, Independent and Non-Independent Directors, the MD & CEO, the Board as a whole and Board-level Committees are mentioned in the Corporate Governance section in the Annual Report.

In terms of the requirements of the Companies Act, 2013, an annual performance evaluation of the Board is undertaken where the Board formally assesses its own performance with an aim to improve the effectiveness of the Board and the Committees. The evaluation process is focused on the functioning of the Board and Committees, such as, composition of the Board and Committees, experience and competencies, performance of specific duties and obligations, governance related matters, etc. As part of implementing best governance practices, the guidance note issued by SEBI on Board Evaluation of listed entities, is also considered while conducting the evaluation exercise. The Board members from different backgrounds bring different expertise that helps Board discussions to be rich and immensely valuable.

Key Consideration 4: The board should contain suitable members with the appropriate skills and incentives to fulfil its multiple roles. This typically requires the inclusion of non-executive Board member(s).

NPCI accepts nomination of a candidate for Board member position as per relevant work experience and technical skills, where participating banks nominate a candidate. The corporate governance handbook states "possesses relevant expertise and experience" as one of the parameters to be taken into consideration for the appointment of Independent Directors.

The Board is led by a Non-Executive Director and Independent Chairman and the composition of the Board represents an optimal mix of professionals, based on knowledge and experience across various fields, viz. Technology, Strategy, Innovation, Banking, Finance and Accounting, Audit, Risk Management, Consumer Engagement, etc. This helps the Board to discharge its responsibilities and provide effective directions and guidance to the leadership team. The individual profile of the Board of Directors is disclosed on NPCI’s website.

NPCI adheres to the regulations stipulated in the Companies Act, 2013 and its corresponding rules. To attract and retain Board members with the necessary skills and expertise, NPCI offers incentives in the form of opportunity to contribute to public good and nation building activities. NPCI is recognized as a national critical infrastructure and holds a significant role in serving the nation. This gives the Board members pride in being a part of an organization that contributes to nation building. This sense of purpose and societal impact serves as a compelling incentive for the Board members to actively participate and contribute to NPCI's long-term objectives.

The sitting fee is provided to Independent Directors, excluding Nominee Directors, who attend Board meetings and Committee meetings. The specific amount of this fee is determined by the Board and it is subject to the prescribed ceiling specified in the Companies Act, 2013 and rules framed thereunder. The Board of NPCI consist of five Independent Directors, which includes one Non-Executive Chairman.

NPCI defines an independent Board member as a non-executive director who does not have any material or pecuniary relationship or transaction that could potentially compromise their independence of judgment. This definition aligns with the criteria outlined in Section 149(6) of the Companies Act, 2013.

NPCI discloses the names and profiles of its Independent Directors on its website and in the Annual Report. This disclosure allows stakeholders and the public to identify Board members NPCI regards as independent.

Key Consideration 5: The roles and responsibilities of management should be clearly specified. An FMI’s management should have the appropriate experience, a mix of skills, and the integrity necessary to discharge their responsibilities for the operation and risk management of the FMI.

NPCI maintains success profiles for all its employees. Roles and responsibilities of management are clearly defined in the ‘success profile’. The success profiles are reviewed and updated on a periodic basis to ensure that roles and responsibilities are aligned to NPCI’s overall objective.

The roles and objectives of management at NPCI are established and evaluated through a well-defined process that aligns with the organization's strategic objectives and changing payment ecosystem. This process involves multiple steps to ensure clarity, alignment and continuous evaluation.

The Key Result Areas (KRAs) setting process plays a critical role in defining the roles and objectives of management. The HR Department collaborates closely with the management team to identify key areas of responsibility and establish specific, measurable objectives that contribute to NPCI's overall success. These KRAs are designed to align with the organization's strategic priorities and take into account industry trends and market dynamics.

Managing Director and CEO's KRA is approved based on the action plan decided in the Board's Strategic Action Plan (STRAP) meeting and Nomination and Remuneration Committee. The approved KRA is then cascaded down to CXOs and Functional Heads, ensuring alignment of objectives throughout the organization. The progress on KRAs and action plans outlined in the STRAP is reviewed by the MD & CEO regularly. The Board reviews the performance of the MD & CEO half yearly.

Once the KRAs are established, regular evaluations are conducted to assess the performance of the management team. This evaluation process may include various methods such as performance appraisals, goal progress tracking, feedback sessions and periodic reviews. The HR Department works in close coordination with the management team to gather relevant data to assess the extent to which the established objectives have been met.

Execution of Risk Management:

NPCI’s risk management and operations functions are headed by CXO level officials assisted by team of professionals with high degree of integrity and adequate skill. All employees are screened to meet the requirements as per HR Policy which emphasizes on high degree of integrity, and skill set commensurate with job role.

Oversight and governance of risk management:

NPCI’s risk management team consists senior officials who have expertise in the fields of payment system, technology, risk management functions, regulatory requirements, etc. The Risk Management Committee of the Board guides the team on oversight and governance of risk management.

NPCI has defined ‘Code of Conduct’ and ‘Separation Policy’ for its employees including management. The policy also describes the removal of management following the due process.

Key Consideration 6: The board should establish a clear, documented risk-management framework that includes the FMI’s risk-tolerance policy, assigns responsibilities and accountability for risk decisions, and addresses decision making in crises and emergencies. Governance arrangements should ensure that the risk-management and internal control functions have sufficient authority, independence, resources, and access to the Board.

NPCI’s Risk Management Committee (RMC), is a designated committee of the Board to ensure robust risk management processes and practices are institutionalized. Risk management function is an independent function that works as second LOD. RMC is responsible for the enterprise level risk management framework, as defined in its charter.

To be aligned with regulatory as well as international leading practices, NPCI has designed the Enterprise Risk Framework/Policy drawing guidance from regulatory guidelines and best industry practices. Framework also includes Enterprise Risk Management (ERM) policy; ERM - Standard Operating Procedure, Settlement Guarantee Mechanism (SGM) policy; SGM- Standard Operating Procedure, Operational Risk Management (ORM) policy; ORM - Standard Operating Procedure, Key Risk Indicators, Risk Appetite, Fraud Risk Management (FRM) policy; FRM - Standard Operating Procedure. These policies have detailed roles and responsibilities of all functions with respect to risk management. This framework applies to organization as a whole and assists in achieving the organizational strategic objectives by bringing a systematic approach for identifying, measuring, analyzing, evaluating, mitigating, monitoring, and reporting risk and control. Some of the risk management measures / functions are listed below:

NPCI has established a board-approved Enterprise Risk Management Framework to periodically measure and monitor the Key Risk Indicators (KRI) across critical risk categories such as Liquidity Risk, Operational Risk and Business Risk. Each KRI has thresholds and risk tolerance limits, which are monitored, and any breaches are discussed, deliberated, and actioned upon by competent authorities. The ERM Framework/Policy broadly outlines the roles and responsibilities of the Board of Directors, Risk Management Committee, Audit Committee, Internal Risk Management Committees, Chief Risk Officer, Senior Management and employees.

NPCI has constituted an independent risk management function that acts as a second LOD. The Chief Risk Officer (CRO) is the owner of the Enterprise Risk Management Framework, Policy and responsible for risk management strategy developments. The risk management framework is periodically reviewed and approved by the Risk Management Committee (RMC) and thereafter by the Board.

The Chief Risk Officer (CRO) is the owner of the Enterprise Risk Management Framework, Policy and responsible for risk management strategy developments. Risk governance framework provides roles and responsibilities of the Risk Management structure of NPCI, through which authority, accountability, competence for managing risk is gained including adequacy, effectiveness and efficiency of controls. The CRO functionally reports to the Risk Management Committee of the Board.

The roles and responsibilities, authority, reporting lines and resources of the audit function are detailed in NPCI's Audit Policy. Audit function is headed by the Audit Head who functionally reports to Audit Committee of the Board. All internal audit reports are reviewed by the Internal Audit Committee and the key findings are reported to the Audit Committee of the Board.

The Risk Management Committee of the Board guides the Risk Management team to ensure adequate governance surrounding the adoption and use risk management models. The Internal Risk Management Committee, which is NPCI’s internal Committee reviews and recommends adoption of various risk management models.

Key Consideration 7: The board should ensure that the FMI’s design, rules, overall strategy, and major decisions appropriately reflect the legitimate interests of its direct and indirect participants and other relevant stakeholders. Major decisions should be clearly disclosed to relevant stakeholders and, where there is a broad market impact, the public.

NPCI has multiple payment products and each product has its own steering committee and user groups, consisting of members related to the specific product. For all important matters and key decisions for a product or related services, steering committee and user groups are consulted.

The Steering Committees include members from participant bank, mix of private/public sector banks, payments bank, small finance bank, Regional Rural Banks/Cooperative, Non-bank, Guest invitee, industry experts.

All operating decisions related to the existing products are discussed at the Steering Committee or working group, as applicable. Any major changes to the existing products are discussed at the product steering committees (comprising of key participants) and inputs are taken from the participants for decision making related to such changes.

NBBL’s Steering Committee is chaired by the CEO of NPCI Bharat BillPay Ltd. (NBBL) and the participating members are licensed/approved entities by RBI known as Bharat Bill Payment Operating Units (BBPOUs). The BBPOUs consist of both Banks and Non-Banks.

Key function of the NBBL’s Steering Committee is to advise on development and overseeing of the implementation of standards for the bill payment system., through a participative decision-making process.

NPCI has constituted a Product Steering Committee which has representatives from member banks, non-banks players, RBI authorized payment system providers, special invitees and subject matter experts. The Committee deliberates to reach consensus for implementing new and/or changes to the existing operating procedures including interchange relating to any product. The management takes into account the steering committee’s consensus and feedback while taking / implementing any business decision which impacts the ecosystem. In certain scenarios, the relevant consensus arrived at the steering committee along with the feedback which may be placed before the relevant board level committee for e.g., Risk Management Committee, Business Strategy Committee.

Given the unique structure where the shareholders of NPCI are also part of the Board, in order to prevent conflict of interest with regards to NPCI product pricing proposal, waivers, fee structures, all proposals are deliberated and recommended only by the Committee of Independent Directors.

NPCI’s provides relevant information regarding its products and services on its website for public disclosure. Any decisions of the Board related to product, polices and operational procedures are communicated to participant members through circulars and other channels. These are also updated on the website of NPCI.

All the major decisions by the Board, including strategic decisions, are informed to the regulators either for their approval or information / noting.

An FMI should have a sound risk-management framework for comprehensively managing legal, credit, liquidity, operational, and other risks.

Key Consideration 1: An FMI should have risk-management policies, procedures, and systems that enable it to identify, measure, monitor, and manage the range of risks that arise in or are borne by the FMI. Risk-management frameworks should be subject to periodic review.

NPCI has identified the following types of risks:

NPCI has defined Enterprise Risk Management (ERM) Framework which includes Enterprise Risk Management Policy. As part of ERM framework, NPCI has further defined Settlement Guarantee Mechanism policy, Operational Risk Management (ORM) policy, Fraud Risk Management (FRM) policy, Third Party Risk Management policy, Information Security Policy. These policies help NPCI to identify, measure, monitor and control key risks.

NPCI has adopted three tier risk assessment approach that enables the Board and other stakeholders to identify, analyze and evaluate risks and business opportunities. The three-tier approach is as under:

NPCI has defined SOPs for executing and operationalization of Risk Management on a day-to-day basis. It includes ERM SOP, ORM SOP, Settlement Risk Management (SRM) SOP, FRM SOP.

The Risk Monitoring tool is used to identify, measure and monitor its range of risk. eFRM tool is used to identify, measure, monitor and manage fraud risk.

Security Incident Event Monitoring tool is used to monitor security events / incidents. Capacity Monitoring tool is used to monitor server capacity. Database Activity Monitoring (DAM) tool is used to monitor database activity. Data Leakage Prevention (DLP) tool is used to prevent data leakage. End Point Security deployed to prevent security to end point devices. Risk Management Team periodically review, make necessary changes in policies and SOPs.

| Sr. No. | Policies/SOP | Author | Reviewed by | Approved by |

|---|---|---|---|---|

| 1 | Enterprise Risk Management Policy | Risk Management | CRO | Risk Management Committee & BOD |

| 2 | Operational Risk Management Policy | Risk Management | CRO | Risk Management Committee & BOD |

| 3 | Settlement Guarantee Mechanism Policy | Risk Management | ERM Head | CRO |

| 4 | Third Party Risk Management Policy | Risk Management | Risk Management Committee | Board of Directors |

| 5 | Information Security Policy. | Information Security (IS) | Risk Management Committee | Board of Directors |

| 6 | Cyber Security Policy | Information Security (IS) | Risk Management Committee | Board of Directors |

| 7 | Business Continuity Management Policy | Information Security (IS) | Risk Management Committee | Board of Directors |

| 8 | Data Privacy Policy | Information Security (IS) | Risk Management Committee | Board of Directors |

| 9 | Enterprise Risk Management SOP | Risk Management | ERM Head | CRO |

| 10 | Operational Risk Management SOP | Risk Management | ORM Head | CRO |

| 11 | Settlement Risk Management SOP | Risk Management | ERM Head | CRO |

| 12 | Fraud Risk Management SOP | Risk Management | FRM Head | CRO |

| 13 | Information Security SOP. | Information Security (IS) | IS Head | CTO |

| 14 | Cyber Security SOP | Information Security (IS) | IS Head | CTO |

| 15 | Business Continuity Management SOP | Information Security (IS) | IS Head | CTO |

| 16 | Data Privacy SOP | Information Security (IS) | IS Head | CTO |

NPCI assess the effectiveness of risk management policies and procedures through periodic review, making necessary changes and presenting the same to the Board for approval. Risk Management function is subject to Audit, which is conducted by independent line of defense.

The effectiveness of Risk Management systems is assessed as per IT and IS policy.

All risk management policies including IS policies and procedures are reviewed and updated at least annually.

Risk Management Policies are approved by the Risk Management Committee and the Board once a year. The day-to-day risk management functions are managed under the supervision and control of Chief Risk Officer assisted by a team of skilled professionals.

Risk Management team regularly reviews various risk parameters considering the fluctuation in risk intensity, changing environments and market practices. For any fluctuation due to risk intensity, changing environments and market practices that requires change in policy or process, such matters are taken up immediately for review in the Internal Risk Management Committee. Thereafter it is referred to the Risk Management Committee of the Board for guidance and directions.

Key Consideration 2: An FMI should provide incentives to participants and, where relevant, their customers to manage and contain the risks they pose to the FMI.

NPCI participants have been provided with Fraud Risk Management (EFRM) tool through which participant bank can monitor real time transactions. Through EFRM solution banks can identify, monitor, analyze and report frauds.

For understanding of rules, procedures and risk management, NPCI regularly shares information to its members and if required through meetings and engagements. NPCI conducts regular workshops, training programs and shares training booklets / literature with participant banks.

Information is disclosed on NPCI’s website - risk management governance, risk management framework, objective of operational risk management, objectives of settlement risk management, Highlights of different ISO certifications and objectives of enterprise risk management.

NPCI has enhanced its system and processes for facilitating online dispute management using APIs for interoperable financial transactions routed through NPCI. NPCI creates awareness program through print and television media. NPCI conducts workshops and training programs regularly for the benefit of the participants. These programs and workshops focus on rules and procedures of NPCI.

Through EFRM solution banks can independently identify, monitor, analyze and report frauds or compromised instances. This works as an incentive for the participants for better risk management at their end. NPCI design its policies and systems keeping in mind the requirements of participants also. NPCI shares the Procedural Guidelines and Operating Settlement Guidelines with participants at the time of onboarding which describes the different types of risk and mitigation action. NPCI issues circulars to the participating banks advising them about the potential risks and management thereof, as and when necessary.

Key Consideration 3: An FMI should regularly review the material risks it bears from and poses to other entities (such as other FMIs, settlement banks, liquidity providers, and service providers) as a result of interdependencies and develop appropriate risk-management tools to address these risks.

NPCI identifies material risk based on the nature of the business activity. NPCI, as a result of interdependencies, has identified material risk as follows:

Settlement risk is monitored through Settlement Risk Management (SRM) tool. Settlement Guarantee Fund (SGF) is created based on defined formula in the SGM Policy. SGF is monitored on quarterly as per the SGM Policy.

Investment concentration risk is controlled through investment policy whereby thresholds are defined for investments in banks and other forms of financial instruments. These investments are continuously monitored through cash flow / fund flow analysis performed regularly.

Settlement is being monitored automatically using Settlement Risk Management tool. This tool is used to monitor daily, monthly & quarterly settlements. In addition, NPCI has implemented EFRM tool for real time transaction monitoring. Member Banks are on-boarded on EFRM tool for identifying, monitoring, analyzing and reporting frauds.

The effectiveness of various risk management tools is assessed on an ongoing basis. Any fluctuation observed are reviewed through internal process to address the risk as per the policy document.

Key Consideration 4: An FMI should identify scenarios that may potentially prevent it from being able to provide its critical operations and services as a going concern and assess the effectiveness of a full range of options for recovery or orderly wind-down. An FMI should prepare appropriate plans for its recovery or orderly wind-down based on the results of that assessment. Where applicable, an FMI should also provide relevant authorities with the information needed for purposes of resolution planning.

NPCI has conducted thorough analysis with various stakeholders to identify scenarios that may potentially prevent the FMI from providing its critical operations. In view thereof, NPCI has a detailed Orderly Wind-Down (OWD) document which is approved by the Board.

For preparing the OWD, NPCI has taken inputs and recommendations from:

The scenarios are taken from the different stakeholders and relevant department heads. Stress scenarios, triggers and their recovery and resolution processes are identified and documented.

Inputs and recommendations were taken from Working Group on Resolution Regime for Financial Institutions Resolution Framework recommended by RBI & Key Attributes of Effective Resolution Regimes for Financial Institutions by Financial Stability Board (FSB).

For each product specific scenarios or the triggers, recovery or resolution process have also been documented in detail. OWD document highlights product level trigger and timeline for resolution. The document includes scenarios wherever recovery is not possible for the respective trigger.

NPCI has also envisaged product specific real and plausible scenarios and the associated triggers where there are good chances of recovery.

NPCI currently holds liquid net assets funded by equity equal to at least six months of current operating expenses in absence of any additional revenue. Such liquid assets (such as reserves) would help in continuity of critical services of NPCI for a duration of at least 6 months.

Recovery and orderly wind down process is detailed in the OWD document. This document is reviewed and updated by risk management team and submitted to RMC for review and suggestions. Post review by RMC, the OWD document is submitted to Board for approval. Recovery and OWD document is reviewed annually.

An FMI should effectively measure, monitor, and manage its credit exposures to participants and those arising from its payment, clearing, and settlement processes. An FMI should maintain sufficient financial resources to cover its credit exposure to each participant fully with a high degree of confidence. In addition, a CCP that is involved in activities with a more-complex risk profile or that is systemically important in multiple jurisdictions should maintain additional financial resources sufficient to cover a wide range of potential stress scenarios that should include, but not be limited to, the default of the two participants and their affiliates that would potentially cause the largest aggregate credit exposure to the CCP in extreme but plausible market conditions. All other CCPs should maintain additional financial resources sufficient to cover a wide range of potential stress scenarios that should include, but not be limited to, the default of the participant and its affiliates that would potentially cause the largest aggregate credit exposure to the CCP in extreme but plausible market conditions.

Key Consideration 1: An FMI should establish a robust framework to manage its credit exposures to its participants and the credit risks arising from its payment, clearing, and settlement processes. Credit exposure may arise from current exposures, potential future exposures, or both.

Framework for managing credit exposure is defined in SGM policy:

Settlement Guarantee Mechanism (SGM) is reviewed as follows:

Key Consideration 2: An FMI should identify sources of credit risk, routinely measure, and monitor credit exposures, and use appropriate risk-management tools to control these risks.

Sources of credit risk at NPCI are identified through SGM Policy and Investment policy.

NPCI has identified following sources of credit risk:

Exposure through participants:

1. NPCI measures and monitors credit risk with respect to settlement as per rules defined in SGM policy. SGF has been created to compensate the settlement obligation in case of default by any participant. Settlement obligations are monitored at the end of each settlement cycle and are cleared within the defined Turn Around Time (TAT).

Exposure through Investments:

2. Investments made with banks are regularly reviewed by the Investment Committee. As per investment policy, the Investment Committee reviews all existing Investments with respect to Net worth, Credit Ratings and Net-Nonperforming Assets (NNPA) criteria to mitigate risk.

The Board is informed periodically about the performance of all investments. Status report on the investment made during a quarter is reported to the Investment Committee, Audit Committee and Board on a quarterly basis.

1. Settlement risk is controlled through Settlement Risk Management (SRM) tool on a daily basis.

2. Investment concentration risk is controlled through investment policy whereby for various types of investments thresholds are defined. Investments are periodically monitored through cash flow / fund flow analysis. Also, investments are regularly monitored by the Investment Committee.

Key Consideration 3: A payment system or SSS should cover its current and, where they exist, potential future exposures to each participant fully with a high degree of confidence using collateral and other equivalent financial resources (see Principle 5 on collateral). In the case of a DNS SSS in which there is no settlement guarantee but where its participants face credit exposures arising from its payment, clearing, and settlement processes, such an FMI should maintain, at a minimum, sufficient resources to cover the exposures of the two participants and their affiliates that would create the largest aggregate credit exposure in the system.

Measures taken to cover exposure in payment system:

1. Settlement Guarantee Fund (SGF): Contribution of 10% of total required SGF is collected in cash or G-Sec (Max up to 50 % of collateral requirement). For the remaining 90% of the SGF, NPCI establishes a Line of Credit arrangement with participant member banks.

These are easily accessible because collaterals are in the form of Cash, G-sec and Line of Credits.

To ensure adequate coverage of current and potential exposures NPCI has set up SGF through Cash, G-sec (as collaterals) and Line of Credits from the banks. These collaterals and Line of Credit provide a high degree of safety and liquidity, in case of settlement obligations.

Key Consideration 4: A CCP should cover its current and potential future exposures to each participant fully with a high degree of confidence using margin and other prefunded financial resources (see Principle 5 on collateral and Principle 6 on margin). In addition, a CCP that is involved in activities with a more-complex risk profile or that is systemically important in multiple jurisdictions should maintain additional financial resources to cover a wide range of potential stress scenarios that should include, but not be limited to, the default of the two participants and their affiliates that would potentially cause the largest aggregate credit exposure for the CCP in extreme but plausible market conditions. All other CCPs should maintain additional financial resources sufficient to cover a wide range of potential stress scenarios that should include, but not be limited to, the default of the participant and its affiliates that would potentially cause the largest aggregate credit exposure for the CCP in extreme but plausible market conditions. In all cases, a CCP should document its supporting rationale for, and should have appropriate governance arrangements relating to, the amount of total financial resources it maintains

Not applicable to Payment System.

Key Consideration 5: A CCP should determine the amount and regularly test the sufficiency of its total financial resources available in the event of a default or multiple defaults in extreme but plausible market conditions through rigorous stress testing. A CCP should have clear procedures to report the results of its stress tests to appropriate decision makers at the CCP and to use these results to evaluate the adequacy of and adjust its total financial resources. Stress tests should be performed daily using standard and predetermined parameters and assumptions. On at least a monthly basis, a CCP should perform a comprehensive and thorough analysis of stress testing scenarios, models, and underlying parameters and assumptions used to ensure they are appropriate for determining the CCP’s required level of default protection in light of current and evolving market conditions. A CCP should perform this analysis of stress testing more frequently when the products cleared or markets served display high volatility, become less liquid, or when the size or concentration of positions held by a CCP’s participants increases significantly. A full validation of a CCP’s risk-management model should be performed at least annually

Not applicable to Payment System.

Key Consideration 6: In conducting stress testing, a CCP should consider the effect of a wide range of relevant stress scenarios in terms of both defaulters’ positions and possible price changes in liquidation periods. Scenarios should include relevant peak historic price volatilities, shifts in other market factors such as price determinants and yield curves, multiple defaults over various time horizons, simultaneous pressures in funding and asset markets, and a spectrum of forward-looking stress scenarios in a variety of extreme but plausible market conditions.

Not applicable to Payment System.

Key Consideration 7: An FMI should establish explicit rules and procedures that address fully any credit losses it may face as a result of any individual or combined default among its participants with respect to any of their obligations to the FMI. These rules and procedures should address how potentially uncovered credit losses would be allocated, including the repayment of any funds an FMI may borrow from liquidity providers. These rules and procedures should also indicate the FMI’s process to replenish any financial resources that the FMI may employ during a stress event, so that the FMI can continue to operate in a safe and sound manner.

NPCI addresses credit losses that may arise due to default by their participants by defined set of rules and procedures. NPCI has established default management procedure in Settlement Guarantee Mechanism (SGM) policy, SOP and product procedural guidelines. It includes managing the defaulted participant’s position, use of available collateral to offset losses and allocation of remaining losses among non-defaulting participants.

NPCI has defined default participant procedure in its settlement guarantee mechanism policy as "As soon as moratorium is declared by RBI or shortfall of funds is experienced in RTGS account during scheduled interbank settlement".

NPCI monitors daily breaches whereby HNDP exceeds SGF amount. In case of default by any participant, SGF is invoked. NPCI has also defined the measures for recovery from the defaulting participant (subsequent to utilization of SGF) which includes recovery of defaulted-amount plus charges and penalties, if any.

Loss Sharing Mechanism (LSM) has also been defined in SGM policy which states that in the event of a moratorium or shortfall in settlement account during scheduled interbank settlement, the net obligation of the defaulted member bank shall be borne by the survivor participant banks. In such an instance NPCI will invoke LSM within defined timelines and surviving member banks will contribute towards LSM as and in the manner prescribed in the SGM document.

NPCI will re-create the SGF. 90 % of required SGF shall be procured by way of Line of Credit and remaining 10% shall be contributed of member banks.

An FMI should effectively measure, monitor, and manage its liquidity risk. An FMI should maintain sufficient liquid resources in all relevant currencies to effect same-day and, where appropriate, intraday and multiday settlement of payment obligations with a high degree of confidence under a wide range of potential stress scenarios that should include, but not be limited to, the default of the participant and its affiliates that would generate the largest aggregate liquidity obligation for the FMI in extreme but plausible market conditions.

Key Consideration 1: An FMI should have a robust framework to manage its liquidity risks from its participants, settlement banks, nostro agents, custodian banks, liquidity providers, and other entities.

NPCI manages its liquidity risk by way of SGM for domestic settlement.

In the case of international alliance, the international partner prefunds amount equivalent to average of 10 days’ settlement value with designated commercial bank. The availability of funds in such designated account is monitored daily. Additionally, SGF amount is maintained as security deposit with NPCI to cover situation where pre-funding amount is exhausted for daily settlement.

When a participant member bank fails to meet the settlement obligation within the prescribed timeline, the settlement amount becomes a liquidity need for NPCI. Maximum size of the liquidity shall be NDC limit assigned to the member bank.

Associated sources of liquidity risks are:

NPCI takes into account the liquidity risk posed by an individual entity and its affiliates that play multiple roles by performing scenario stress testing, recalibrating SGF composition, analysis of HNDP, etc.

Key Consideration 2: An FMI should have effective operational and analytical tools to identify, measure, and monitor its settlement and funding flows on an ongoing and timely basis, including its use of intraday liquidity.

NPCI’s Settlement is being monitored automatically using SRM tool. This tool is being used to monitor settlement obligations on Daily, Monthly & Quarterly basis.

NPCI uses automated tools to monitor and share ‘Net Settlement Report’, Daily Settlement Report, etc. in electronic format.

All settlement files are posted automatically in ‘RTGS account’ of members. Alerts are generated for any failure in posting the settlement file. Though rare, such cases are immediately reviewed, rectified to address reason for failure and reposted in the RTGS.