UPI-ICD (Interoperable Cash Deposit) is a service that allows customers of participating banks who are active on UPI to deposit cash at any bank's cash recycler or deposit machine that supports UPI-ICD without the need for a card. Customers can deposit cash into their own accounts or into any other bank account using one of the following methods - (a) a mobile number linked to UPI, (b) VPA, or (c) the beneficiary's account IFSC code via a UPI-ICD-enabled app.

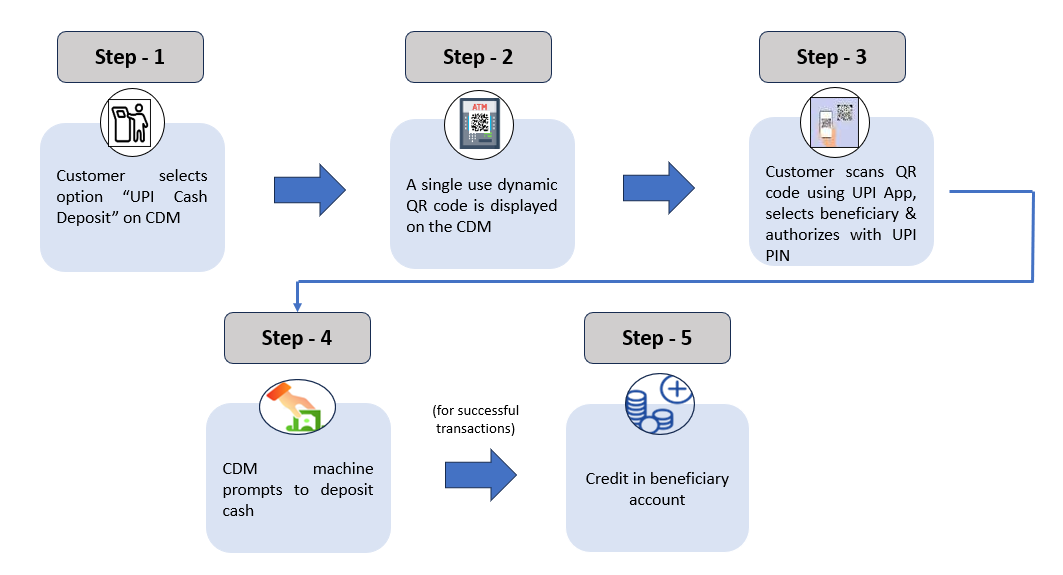

When the customer selects the "UPI cash deposit" option at the cash recycler or deposit machine (CDM), a dynamic QR code appears on the CDM screen. The customer then scans the QR code using their UPI app and selects the beneficiary's account for the deposit. The beneficiary's name displays on the UPI app for confirmation. The customer verifies the beneficiary and authorizes the transaction using their UPI PIN. Once authorized (including both the depositor's authentication and the beneficiary's account validation), the customer is prompted to deposit cash into the CDM's cash slot. After the CDM verifies the cash, the deposit is completed, and the beneficiary's account is credited through UPI.

The deposit can be done in a UPI-enabled own account or third-party account.

Some of the key features of the service are as follows:

| Sr. No | Bank Name | Depositor | Beneficiary | Acquirer | UPI APP |

|---|---|---|---|---|---|

| 1 | BHIM UPI App | NA | NA | Live | |

| 2 | Slice UPI APP | NA | NA | Live | |

| 2 | AU Small Finance Bank | Live | Live | - | - |

| 4 | Bank of Baroda | Live | Live | Pilot Live | - |

| 5 | Canara Bank | Live | Live | - | - |

| 6 | Central Bank of India | Live | Live | - | - |

| 8 | Hitachi | NA | NA | Live | - |

| 9 | IDFC Bank | Live | Live | - | - |

| 10 | Indian Bank | Live | Live | - | - |

| 11 | Indian Overseas Bank | Live | Live | - | - |

| 12 | Punjab National Bank | Live | Live | - | - |

| 13 | Ujjivan Bank | Live | Live | - | - |

| 14 | Union Bank Of India | Live | Live | - | - |

| 15 | Yes Bank | Live | Live | - | - |

| 16 | Slice Small Finance Bank | Live | Live | - | - |

| Sr. No | Bank Name | Issuer | Beneficiary | Acquirer | UPI APP |

|---|---|---|---|---|---|

| 1 | Janata Sahakari Bank | Live | Live | - | - |

| 2 | Saraswat Co-operative Bank | Live | Live | - | - |

| 3 | Thane Janata Sahakari bank | Live | Live | - | - |

As on Aug 2025

Note: Customers of (Live) Issuer banks’ can do card less cash deposit transaction using the UPI APP on UPI-ATM enabled machines of Acquirer Banks/WLAOs