RuPay is the first-of-its-kind domestic Card payment network of India, with wide acceptance at ATMs, POS devices and e-commerce websites. It is a highly secure network that protects against anti-phishing. The name, derived from the words ‘Rupee and ‘Payment’, emphasizes that it is India’s very own initiative for Card payments. It is our answer to international payment networks, expressing pride over our nationality.

RuPay fulfils RBI’s vision of initiating a ‘less cash’ economy. This could be achieved only by encouraging every Indian bank and financial institution to become tech-savvy and engage in offering electronic payments.

RuPay is a product of NPCI, the umbrella organisation that powers retail payments in the country. The provision under the Payment and Settlement Systems Act, 2007, empowered the Reserve Bank of India (RBI) to create a secure electronic payment and settlement system in India.

The nature of NPCI’s initiatives and objectives includes it under the “Not for Profit Company” under the provisions of Section 25 of the Companies Act 1956 and more recently under the Section 8 of the Companies Act 2013. This was an initiative to build the necessary banking infrastructure required to propel India towards a ‘less cash’ economy. NPCI recognises the need for tech-driven innovations in the retail payments system to drive operational efficiencies among

RuPay has made a significant impact on the retail payment systems in the country. Dedicated to the nation by our Hon'ble President, Shri Pranab Mukherjee, endorsed by the Hon'ble Prime Minister, Shri Narendra Modi and later made the card of choice for the ambitious Pradhan Mantri Jan Dhan Yojana, RuPay is now a known name.

RuPay has launched various card variants catering to the different segments of the society.

In addition to the Government scheme cards, RuPay Classic, Platinum & Select variant cards are designed for the masses and affluent customers. RuPay offers excellent privileges and benefits such as International Acceptance, Domestic and International Airport Lounge Access, Concierge services, free personal accidental death and permanent total disability insurance coverage , various merchant offers, different Cashback scheme, Health and Wellness benefits to appeal to the mass and affluent customers.

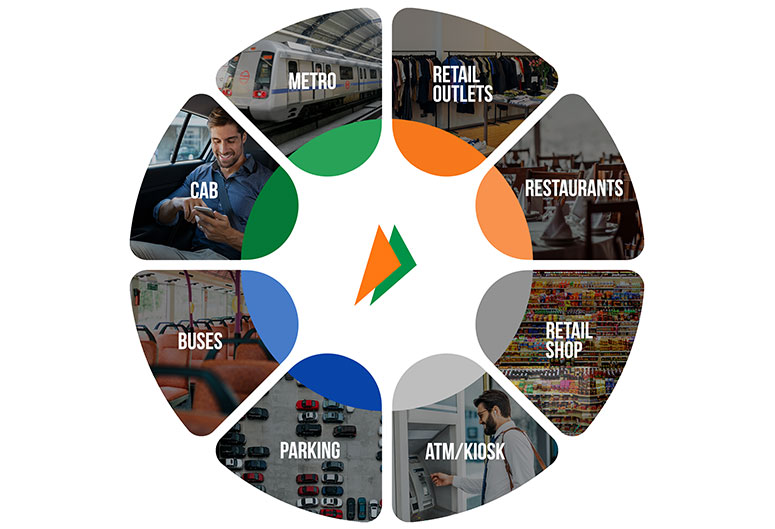

Keeping in pace with continuous development and innovation in the ecosystem, RuPay has developed a bouquet of new innovative products such as RuPay Contactless With the vision of One Card for all Payment systems, RuPay Contactless has revolutionized payments by introducing offline wallet-based payment mechanisms and service area features for storing merchant/operator-specific applications. This product enables seamless payment across all use cases, including travel by different metros and other transport systems across the country, retail shopping, and purchases.

Make payments more convenient and safer with no physical connection, just a tap of your RuPay Contactless card on the reader helps to make all your payments.

An overarching vision for payment systems at this juncture needs greater adoption of electronic payments and migration towards a “less-cash” society. Contactless payments are the future of payment industry in India.

RuPay Contactless has revolutionized payments by not just providing contactless payment options to you, but also introducing wallet-based contactless payments (offline payments) and service area features for storing operator-specific passes.

In a nutshell, RuPay Contactless offers:

RuPay has worked with Ministry of Housing & Urban Affairs (MoHUA), Government of India for implementation of National Common Mobility Card (NCMC) program across the country with the vision of ‘One Card for all Payments (Transit as well as Retail)’. RuPay Contactless card is in line with the specifications of National Common Mobility Card (NCMC) Program. This card envisages the development of a cashless fare payment mechanism, which will work across all the public transport systems in the country such as metros, buses, cabs etc.; leading to establishment of an Interoperable Fare Management System (IFMS)

As part of India's evolving regulations aimed at enhancing the security of online transactions and global standard acceptance, NPCI has enabled RuPay ecommerce transactions on EMV 3-D Secure transaction named as ‘NPCI SecureNxt’. This enhancement allows RuPay to process transactions for ‘Card Not Present (CNP)’ as per the EMV 3DS specification. It provides a strong security layer for user authentication.

As India strengthens its regulatory framework to enhance the security of online transactions and align with global standards, NPCI has enabled RuPay ecommerce transactions on EMV 3-D Secure transaction named as ‘NPCI SecureNxt’

Device Tokenization is a cutting-edge security feature that replaces your actual card details with a unique, encrypted token—securely stored on your device. This token is device-specific and can be used for seamless and secure digital payments across mobile apps, websites, and wearables. With real-time token provisioning, users can tokenize their cards instantly via their Third Party Apps, ensuring fast, frictionless payments.

By eliminating the need to store or share sensitive card information, device tokenization drastically reduces the risk of fraud and data breaches. It offers a smoother checkout experience with one-tap payments, lowers chargeback rates for merchants, and aligns with global PCI-DSS standards. Whether you’re a customer, merchant, or payment platform, device tokenization ensures a secure, convenient, and future-ready payment experience.

RuPay AutoPay is a recurring payment solution by NPCI, enabling users to automate payments via RuPay debit, credit, and prepaid cards. It ensures seamless processing for subscriptions, utility bills, insurance premiums, and EMIs, eliminating manual intervention. RuPay AutoPay is a seamless and secure recurring payment solution that enables customers to automate payments using RuPay debit and credit cards.

Designed to meet India's growing digital payment needs, RuPay AutoPay enhances transaction success rates, merchant acceptance, and user convenience. It serves as a cost-effective domestic alternative to global subscription management solutions.