An instant payment system designed for users with feature phones and users with limited or no internet connectivity.

Safely and securely utilize Unified Payments Interface (UPI) services through four convenient technology options:

1. Calling an IVR number

2. Using app functionality on feature phones

3. Missed call-based approach

4. Exploring proximity sound-based payments.

Now, users with feature phones and users with limited or no internet connectivity can also easily engage in a variety of transactions with ease.

Call karo

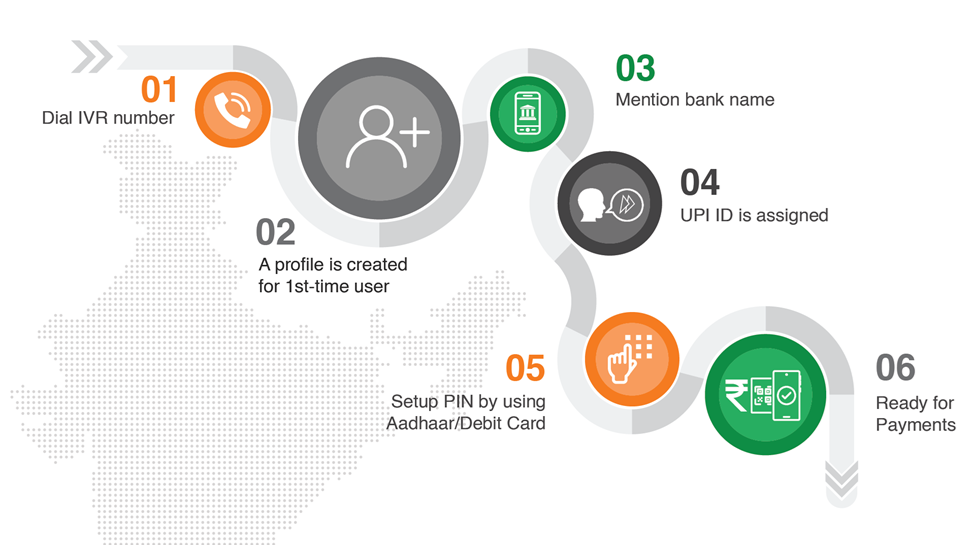

Call on pre-defined IVR number

Choose karo

Select mode of transaction

Pay karo

Enter UPI PIN to pay

Make transactions seamlessly through UPI payments on any phone by initiating a secure call to pre-defined IVR number. Complete UPI onboarding formalities without an internet connection. Multiple language options are also available on the IVR for your convenience. Multiple banks and multiple service providers support payments through IVR functionality. Details of each bank and each service provider is given under the 123Pay live members section.

A. Money Transfer: Jai, a parent in a remote village, enrolls in UPI 123PAY via IVR to send money to his daughter studying in the city using his feature phone.

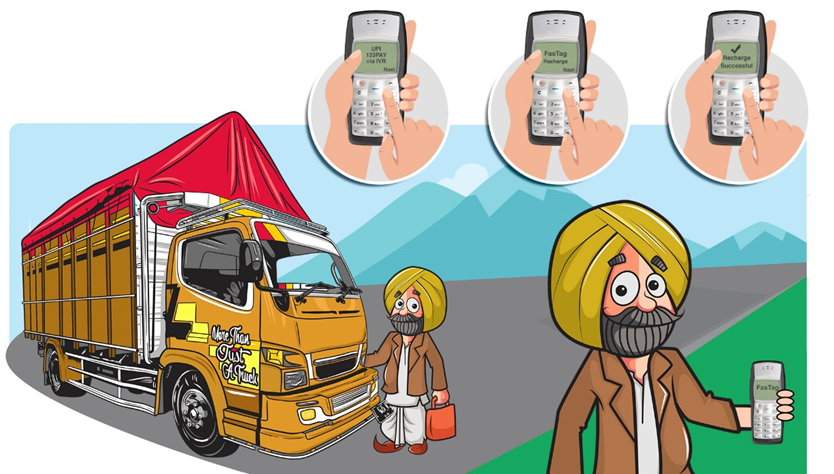

B. FASTag Refill: Sukhi, an intercity truck driver, reloads his FASTag using his feature phone by dialing the IVR number and following authentication steps

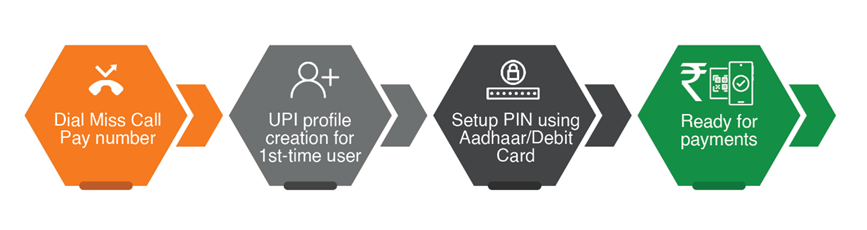

The Missed Call-based approach for users with feature phone and users with limited or no internet connectivity enables routine banking transactions by providing a missed call to the designated IVR number. When user makes a purchase, a token with the customer's mobile number and the bill amount is generated

Post giving a missed call, user receives an immediate incoming call on the registered mobile number. The onboarding process is like IVR based approach. The call then prompts the user to authenticate the transaction by entering their UPI PIN.

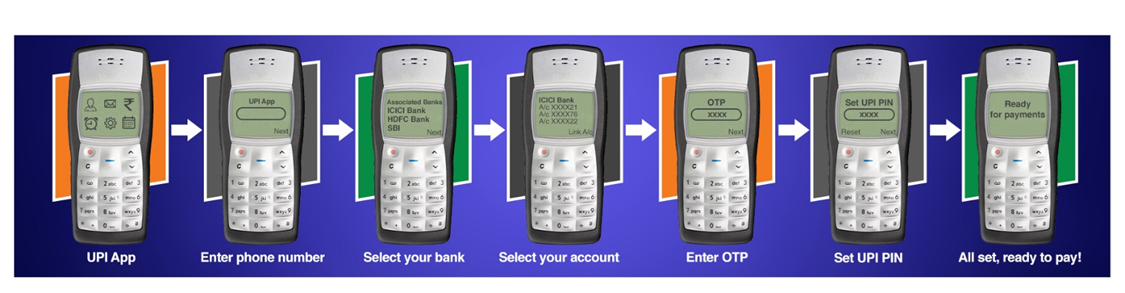

The digital solution for UPI on feature phones is an app created by Gupshup in collaboration with Airtel Payments Bank and JioPay in collaboration with Jio Payments Bank. To execute this, solution providers must partner with feature phone manufacturers (OEM) to integrate a native payment app in the feature phone.

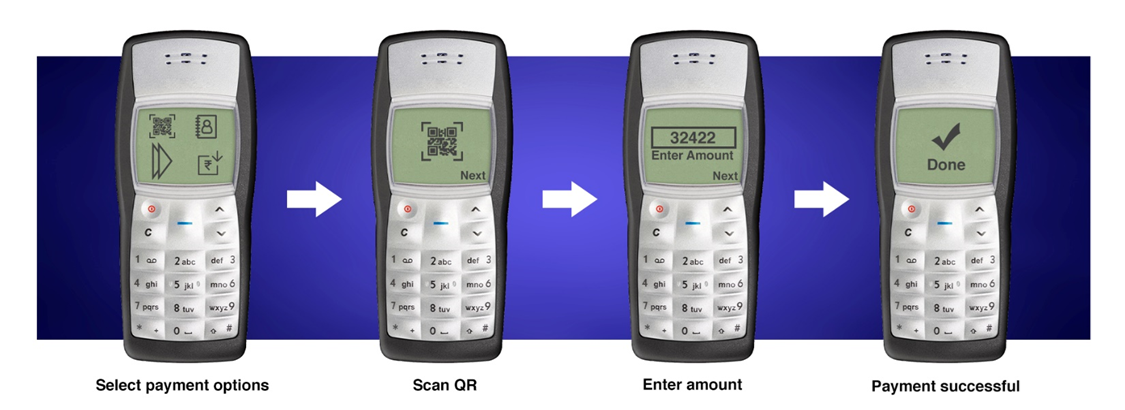

The app's interface is similar to a smartphone app but with certain limitations due to feature phone constraints. It currently supports most UPI functionalities, including Scan and Pay from a feature phone with camera access.

The proximity sound-based payment solution, allows users to make contactless UPI payments to merchants.

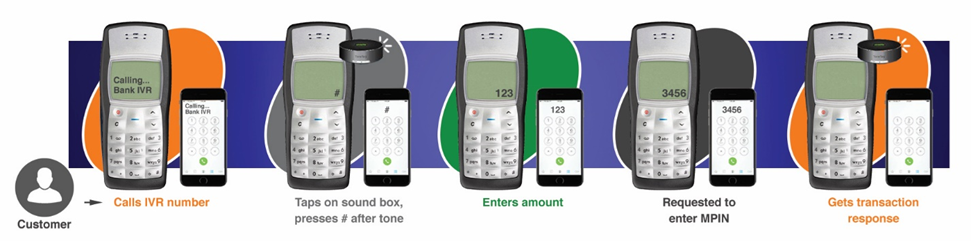

Users call the IVR number choose Pay to Merchant, tap their phone on the merchant's device (Sound Box), press # upon hearing the unique tone, enter the payment amount and UPI PIN, and complete the transaction. The sound box confirms the transaction status, and users receive confirmation on the IVR call.