A QR code consists of black squares arranged in a square grid on a white background, which can be read by an imaging device such as a camera. QR contains information about the item to which it is attached.

Bharat QR is P2M (Person to Merchant) Mobile payment solution.

This solution is mutually derived among NPCI, Visa and Mastercard payment networks. Once the BQR codes are deployed on Merchant locations, user can pay the utility bills using BQR enabled mobile banking apps without sharing any user credentials to the merchant. It is a quick method of payment.

Bharat QR works as an alternate channel of payment, where cardholder has to download his/her bank’s Bharat QR enabled mobile banking app. User has to scan the Bharat QR code at Merchant store and select card to make payment. Once the payment is successful, both cardholder and merchant receive notification in mobile application for successful transaction.

Bharat QR transactions are different from POS transactions. In POS transaction, POS terminal is required whereas in Bharat QR transaction, QR Code is required. Using mobile banking app or wallet user will scan the QR Code placed in merchant outlet and make the payment using the RuPay Card linked to the BQR.

Any store who has displayed Bharat QR code mark in their store.

Unlike other QR Codes, Bharat QR code has lots of additional data elements like merchant name, address, Merchant Bank information, etc... Bharat QR code is much more widely acceptable and secure than other QR codes. Users can pay using any card scheme such as - RuPay, Visa, MasterCard and Amex.

a) User should have Mobile banking application of respective bank. User can download the same from google play store (Android) / App store (iOS).

b) The same Merchant has to be live on Bharat QR code with user’s respective bank.

BHIM QR is UPI Based QR. It is preferably used for P2P or P2M dynamic Transaction using Virtual Payment Address.

Bharat QR is specifically used for P2M transaction wherein payment is done via cards i.e., Debit card/Credit Card/Pre-paid Card.

In order to enable Bharat QR on the smart phone, the cardholder should follow the below mentioned steps:

a) Download the Bank’s Mobile Application, wallet which supports Bharat QR from

google play store/app store.

b) Do one time registration for linking the debit/credit/pre-paid card with Bank’s

application.

c) Go to the merchant store where payments through Bharat QR code is accepted.

d) Click on Bharat QR icon from app to make payment through Bharat QR code.

Yes, any RuPay card (Debit / Prepaid / Credit / Virtual Card) which is linked to the customer’s account / wallet can be used to make payments through Bharat QR.

Yes, the card holder has to do one time registration of card in the mobile application and link the card with application to make payments through Bharat QR.

Cardholders have to register themselves with their respective Bank’s Bharat QR

enabled mobile banking application.

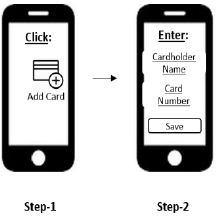

Upon successful login, Cardholder needs to click add/link card tab given in the app.

Upon successful login, Cardholder needs to click add/link card tab given in the app. Then below mentioned steps have to be followed:

In some cases, card auto linking feature is available.

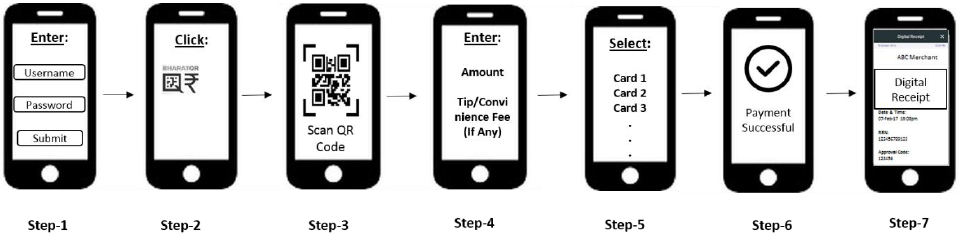

Refer the below screenshots explaining Transaction Flow

1. Download & open Bharat QR enabled mobile application.

2. Enter username & password for login.

3. Click on pay by Bharat QR option given on the home screen.

4. Scan merchant Bharat QR code.

5. Enter amount to be paid along with tip/convenience fee (if applicable).

6. Select RuPay or any other card linked to the user, for payment.

7. User will receive payment confirmation message.

8. User will receive digital receipt.

Customer will receive notification on the mobile banking application / through SMS confirming that the transaction has been performed successfully.

Your bank needs to be enabled on Bharat QR solution.

There are no additional charges for making transaction through Bharat QR.

You can only link multiple cards of the same bank in a single app.

Post Transaction completion, all transactions will reflect in the 'Transaction History' Section of the App. Similarly, all transactions will replicate on your bank account statement.

Yes, your account needs to be enabled for mobile banking for Bharat QR payments.

Yes, it has to be same. This is one way of authentication.

Yes, if the existing wallet has an option to pay using Bharat QR.

The cardholder needs to follow below steps-

a. Cardholder has to click on the ‘transaction history’ tab given in the app.

b. Record the failed transaction details.

c. Report to issuing bank with the failed transaction details or user can also raise

complaint in app.

In case the cardholder’s account is debited but the merchant has not received the Payment, the money will be automatically refunded back into cardholders account.

Sometimes this takes longer than intended time. Incase if cardholder has not received the refund within 24 hours, customer should contact customer support of the bank. Cardholder can also raise a chargeback through proper channel as prescribed by the respective banks.

No problem, the mobile application will prompt you to re-enter the correct PIN. The maximum number of tries allowed, depends on your bank. Please check with your bank for details.

First check the mobile network. If still not receiving OTP, kindly contact your bank.

Incase if you lose your phone then login PIN required to authorize all transaction will not be known to any third person and third person will not be able to make any payments. In addition, also contact customer support of your bank.

If you change your handset, you will need to

a. Download the app enabled with Bharat QR again.

b. Login with your mobile number and password.

c. Allow the app to verify you. This is for your security. After verification your

account will be restored.

If you change your handset, you need to

a. Download the mobile banking app again

b. Login with your mobile number and password

c. Allow the app for verification. This is for user security. Post verification your

account will be restored.

The 2FA for Bharat QR is –

1. First factor is MPIN for the mobile application login.

2. Second factor is taken as MPIN/OTP/ATM pin but it is Bank’s discretion to apply

the second factor.

No, the transaction can be done any time, i.e., (24*7*365).

The per day transaction limit is set at Bank’s end. Please contact respective Bank for further information.

Yes, customer will get an option to enter the amount in the app after scanning the QR code. At the time of entering the amount, customer can enter part of the amount through Bharat QR and remaining as they want.

Once you complete a transaction, you should see a success status on the App screen and receive an SMS from your bank.

In some cases due to operator issues, it takes longer time.

In case if you have not received a confirmation, do contact customer support of your bank.