Understanding Asset Tokenization to Unlock Digital Asset Potential

Authors:

Asset tokenization stands at the forefront of financial innovation, fundamentally reshaping how we perceive ownership and investment in the digital age. This groundbreaking process converts ownership rights of real-world assets—ranging from real estate and commodities to artwork and financial instruments—into digital tokens secured on blockchain networks. As traditional boundaries between physical and digital assets continue to blur, tokenization emerges as a powerful mechanism democratising access to investment opportunities previously reserved for institutional players or high-net-worth individuals.

The financial world witnesses an unprecedented shift as tokenization bridges the gap between traditional asset management and cutting-edge blockchain technology. This convergence creates new possibilities for fractional ownership, enhanced liquidity, and streamlined transaction processes that were unimaginable just a decade ago. The implications extend far beyond simple digitisation, fundamentally altering how markets operate and how investors interact with diverse asset classes.

Decoding the Asset Tokenization Process

Asset tokenization represents more than technological advancement—it embodies a paradigm shift in ownership representation and value exchange. The process involves converting real-world assets into digital tokens on blockchain platforms, creating new opportunities for fractional ownership and global trading.

The tokenization mechanism follows a structured approach that ensures security, compliance, and market accessibility:

- Asset Identification: Evaluating assets for tokenization potential based on market demand, regulatory compliance, and technical feasibility. Properties, artworks, bonds, and commodities are assessed for successful tokenization criteria.

- Legal and Regulatory Structuring: Establishing frameworks through Special Purpose Vehicles (SPVs) that define ownership rights, investor protections, and compliance measures. This ensures legal clarity and investor confidence throughout the lifecycle.

- Token Creation and Issuance: Generating digital tokens on blockchain platforms representing fractional ownership stakes. These tokens function as digital certificates enabling precise asset value division among multiple investors.

- Smart Contract Deployment: Implementing self-executing blockchain contracts that automate dividend distribution, profit-sharing, voting rights, and ownership transfers while eliminating intermediaries and reducing costs.

- Market Listing and Trading: Facilitating transparent trading through digital exchanges, enabling global investor access to previously illiquid assets and expanding market participation beyond traditional constraints.

This structured approach transforms how assets are owned, traded, and managed, creating unprecedented opportunities for market participation and value creation in the digital economy.

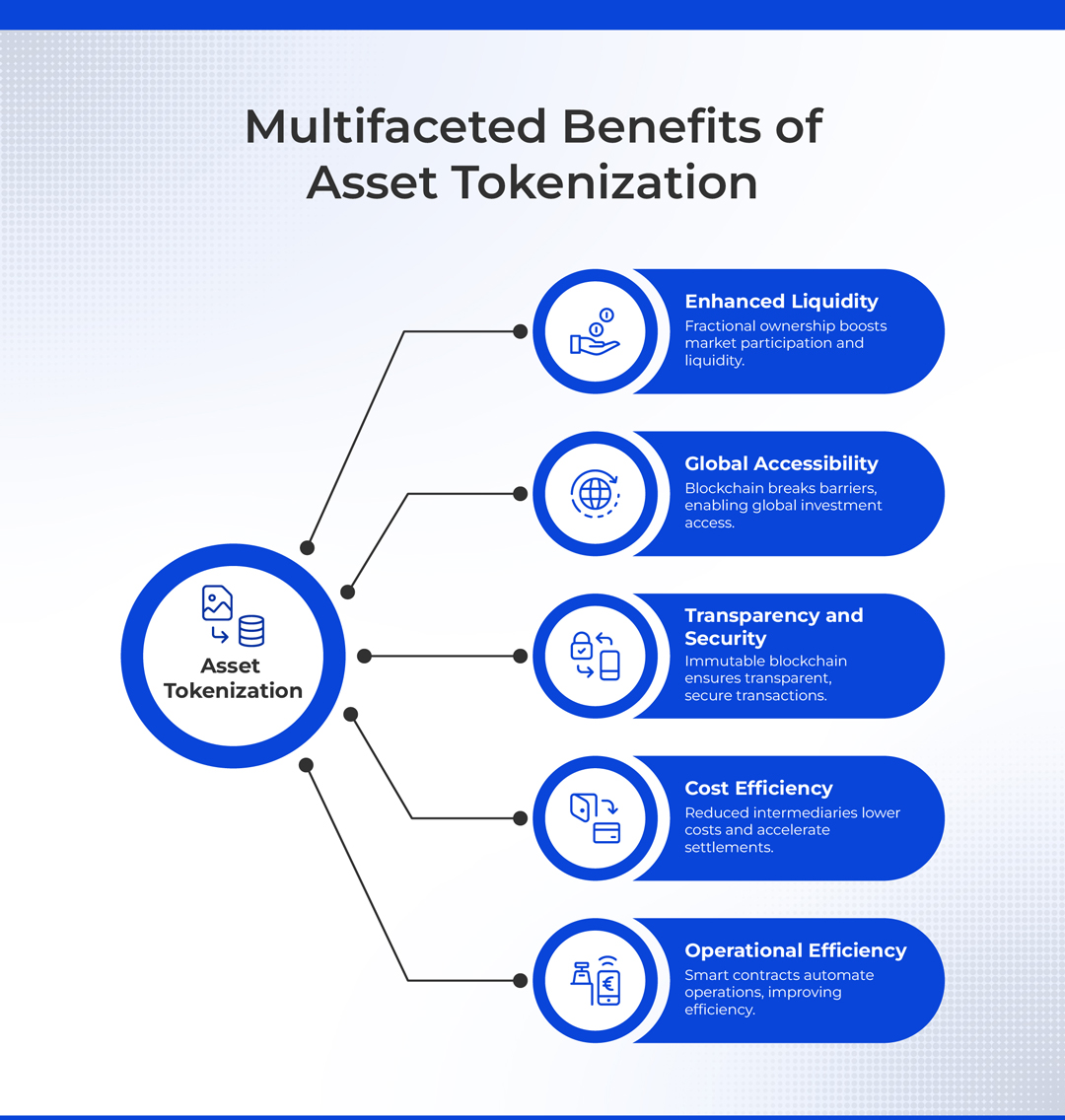

Transformative Benefits Reshaping Investment Markets

Asset tokenization delivers significant advantages that are revolutionising traditional investment paradigms. These benefits address long-standing market inefficiencies while creating new opportunities for both institutional and retail investors.

The key transformative benefits include:

- Enhanced Liquidity: Enables fractional ownership allowing multiple investors to participate in markets traditionally requiring substantial capital. Real estate and fine art markets become accessible to broader investor bases through tokenized representations.

- Global Accessibility: Breaks down geographical and financial barriers through blockchain platforms facilitating worldwide participation. Emerging market investors can access developed economy assets while institutions diversify across previously inaccessible asset classes.

- Transparency and Security: Benefits from blockchain's immutable nature ensuring tamper-proof transaction records that enhance investor trust and reduce fraud risks. Every transaction remains permanently recorded, creating auditable trails.

- Cost Efficiency: Results from reduced intermediaries, lower transaction costs, and accelerated settlement processes through blockchain automation. Streamlined processes reduce fees and enable more efficient capital allocation.

- Operational Efficiency: Improves through smart contracts automating complex functions, reducing human error and improving accuracy. Automated systems handle routine operations like dividend payments and compliance reporting without manual intervention.

These benefits collectively create a more efficient, accessible, and secure investment ecosystem that democratizes participation while maintaining institutional-grade security and compliance standards.

Real-World Applications Demonstrating Market Viability

Asset tokenization has moved beyond theoretical concepts to practical implementations across diverse industries. These real-world applications showcase the technology's versatility and potential to transform traditional asset management approaches.

- Real estate tokenization platforms exemplify the practical application of these concepts. Companies like RealT enable investors to purchase fractional ownership of properties digitally, providing exposure to real estate markets without traditional barriers such as large down payments, property management responsibilities, or geographical limitations. These platforms demonstrate how tokenization can unlock value in traditionally illiquid markets.

- Art market innovations through initiatives such as Maecenas showcase tokenized investments in valuable artworks, democratising art ownership and providing liquidity in historically illiquid markets. Investors can own fractions of masterpieces, participate in art market appreciation, and trade their holdings without physical possession concerns.

- Financial instruments benefit from tokenization through companies like Securitize that offer platforms for tokenizing securities, bonds, and investment funds. These solutions facilitate streamlined management, enhanced market reach, and improved accessibility for both issuers and investors seeking diversified portfolio exposure.

These applications demonstrate that tokenization is not merely a technological experiment but a viable solution addressing real market needs across multiple asset classes and investor segments.

Market Growth Projections Signal Massive Opportunity

Market research reveals extraordinary growth potential for asset tokenization across multiple industries. Boston Consulting Group and Ripple estimate that asset tokenization will reach approximately $18.9 trillion globally by 2033, highlighting significant growth potential and widespread market acceptance across finance, real estate, and alternative investments.

McKinsey & Company provides complementary forecasts, projecting tokenized assets to achieve market capitalisation of around $2 trillion by 2030, with optimistic scenarios potentially exceeding $4 trillion. These projections reflect growing institutional interest and regulatory clarity that supports broader adoption of tokenization technologies.

The security token market specifically shows remarkable growth potential, with projections reaching approximately $30 trillion by 2030. This growth stems from extensive tokenization of real estate portfolios, financial securities, commodities, and alternative investments that previously remained inaccessible to many investors.

Global Standards and Tokenization Frameworks

As asset tokenization matures, globally harmonized frameworks become essential for mainstream adoption. These standards reduce market fragmentation, enhance legal clarity, and ensure interoperability between blockchain networks and regulatory systems.

Leading Global Frameworks

Industry bodies have developed structured frameworks defining how tokens should be managed and governed:

- Token Taxonomy Framework (TTF): Led by Enterprise Ethereum Alliance, providing templates for token characteristics and regulatory compliance.

- ISO/TC 307: International standardisation initiative covering smart contracts, digital identity, and security protocols.

- Hyperledger FireFly: Open-source enterprise framework enabling tokenization and distributed ledger integration.

Essential Token Standards

Token standards define how digital assets behave and interact across platforms:

Infrastructure Standards

Successful tokenization requires robust infrastructure addressing custody, compliance, and interoperability:

- Digital Custody: Multi-Party Computation solutions like Fireblocks provide institutional-grade security.

- Cross-Chain Solutions: Chainlink CCIP and Cosmos IBC enable secure transfers across blockchain networks.

- Identity and Compliance: W3C DIDs and FATF Travel Rule ensure robust KYC and AML compliance.

These standards create the foundation for secure, compliant tokenized asset ecosystems that institutions and regulators can confidently adopt.

Global Case Studies Demonstrating Practical Success

Leading financial institutions and innovative companies worldwide have successfully implemented tokenization projects, providing valuable insights into best practices and market potential. These case studies demonstrate the practical viability of asset tokenization across different sectors and geographies.

- The St. Regis Aspen Resort tokenization in 2018 marked a significant milestone when Elevated Returns issued 18 million digital tokens on the Tezos blockchain, representing fractional ownership of this luxury property. This initiative enabled accredited investors to own shares of high-value real estate, significantly improving liquidity in traditionally illiquid markets while maintaining the asset's inherent value proposition.

- BlackRock's BUIDL Fund launch in 2024 represents institutional adoption of tokenization principles. This tokenized money market fund on the Ethereum blockchain combines traditional financial instruments with decentralized finance elements, offering investors stable tokens with real-time interest accrual. The initiative demonstrates how established financial institutions embrace blockchain technology for enhanced transparency and efficiency.

- Sygnum Bank's Picasso artwork tokenization in 2021 showcased art market applications when the bank tokenized Picasso's "Fillette au beret," enabling 50 investors to acquire fractional shares through 4,000 tokens. This project significantly democratized access to high-value art investments while enhancing asset liquidity through blockchain-enabled trading mechanisms.

- JPMorgan and Apollo's collaboration in 2023 created blockchain-based wealth management platforms enabling diversified tokenized portfolio management across multiple blockchains. This partnership streamlined portfolio management while enhancing transparency and efficiency for both institutional and retail investors seeking exposure to tokenized assets.

These successful implementations provide compelling evidence that asset tokenization can deliver tangible benefits while maintaining security, compliance, and investor protection standards required for institutional adoption.

Navigating Implementation Challenges

While asset tokenization offers significant opportunities, successful implementation requires addressing several key challenges that can impact adoption and market confidence. Understanding and preparing for these obstacles is essential for organisations considering tokenization initiatives.

The primary implementation challenges include:

- Regulatory and Legal Ambiguities: Uncertainty surrounding digital token classification, compliance requirements, and cross-border transaction frameworks can slow adoption and diminish investor confidence. Clear, well-defined regulations remain essential for investor protection and market stability.

- Technical Infrastructure Demands: Robust systems capable of supporting high transaction volumes while maintaining security standards and ensuring seamless interoperability among multiple blockchain networks. Scalability and performance requirements continue growing as adoption increases.

- Security and Privacy Concerns: Tokenization platforms face cybersecurity risks requiring advanced cryptographic methods, secure storage solutions, and regular security audits to protect against evolving threats despite blockchain's inherent security advantages.

- Market Acceptance Dependencies: Success depends heavily on investor awareness, education, and trust development. Many investors and financial institutions remain unfamiliar with tokenized assets, requiring comprehensive education programs and successful implementation demonstrations.

Addressing these challenges proactively through careful planning, robust technical architecture, comprehensive compliance frameworks, and stakeholder education will determine the success of tokenization initiatives in today's evolving financial landscape.

Charting the Path Forward

Asset tokenization represents a fundamental shift in how markets operate and how investors access diverse asset classes. The combination of technological advancement, regulatory development, and growing market acceptance creates unprecedented opportunities for financial innovation and inclusion.

Success in this emerging field requires careful attention to regulatory compliance, robust technical infrastructure, comprehensive security measures, and ongoing investor education. Organisations that master these elements while maintaining focus on practical applications and real-world value creation will lead the evolution toward more accessible, efficient, and inclusive financial markets.

The journey toward widespread asset tokenization adoption continues, with each successful implementation building confidence and demonstrating practical benefits. As technology matures and regulations clarify, tokenization will likely become a standard component of modern portfolio management and investment strategy, fundamentally reshaping how we think about ownership, value, and market participation in the digital age.