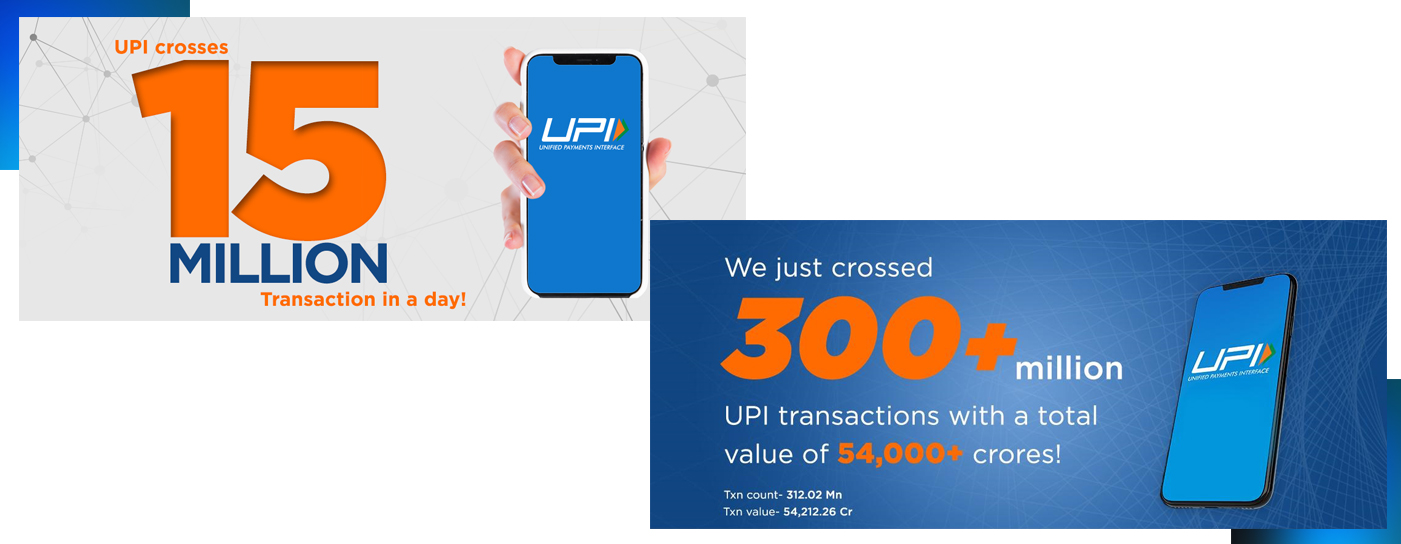

BHIM UPI hits 15 million transactions on single day

NPCI is pleased to share that we hit 15 million Bharat Interface for Money - Unified Payments Interface (BHIM UPI) transactions in a single day on September 5 2018. BHIM UPI has achieved over 312 million transactions in the month of July. The total value of transactions stood at Rs. 54,212 crore. UPI volume (UPI, BHIM and USSD 2.0 -*99#) during August, July and June were 312 million, 235 million and 246 million while the value stood at Rs. 54,212 crore, Rs. 45,845 crore and Rs. 40,834 crore respectively. The data excludes the transactions having debit/credit to the same account from July 2018 onwards.

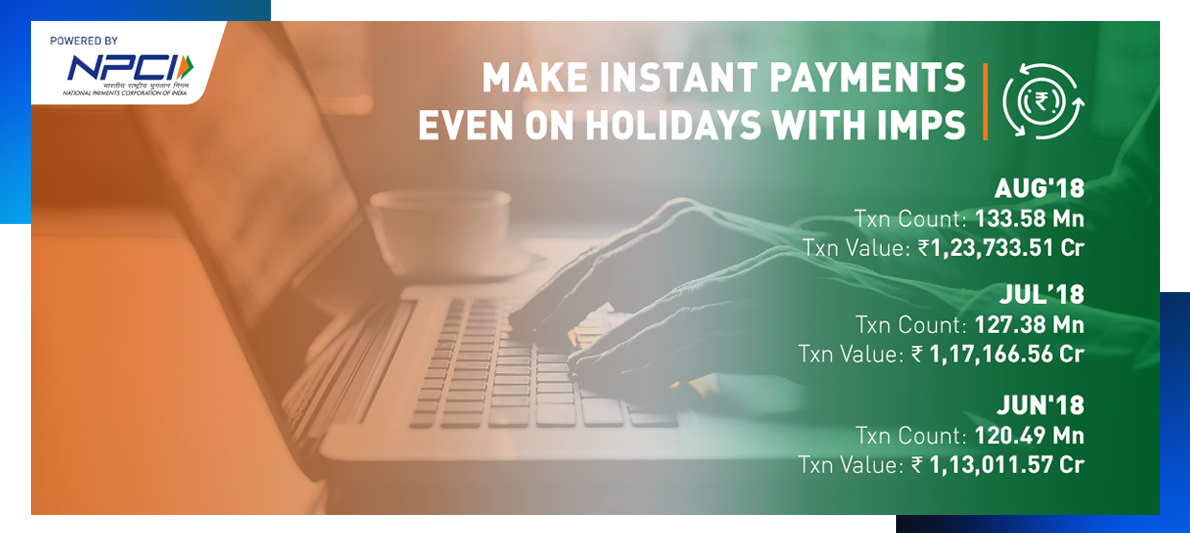

IMPS clocks over 133 million transactions

Immediate Payment Service (IMPS), the platform which works 24 X 7 has achieved over 133 million transactions in the month of August. The total value of transactions stood at Rs. 1,23,733 crore. IMPS volume during August, July and June were 133 million, 127 million and 120 million while the value stood at Rs. 1,23,733 crore, Rs. 1,17,166 crore and Rs. 1,13,011 crore respectively. IMPS provides robust and real time fund transfer service which offers an instant, 24X7, interbank electronic fund transfer service that could be accessed on multiple channels like Mobile, Internet, ATM, SMS and Branch. As on August 2018, total number of banks live on IMPS platform were 394.

National Financial Switch empowers 450 co-operative banks through Sarvatra Technologies

Sarvatra Technologies have successfully on-boarded ‘Sevalia Urban Co-operative Bank’ as 450th co-operative bank on National Financial Switch (NFS) platform. The company has enabled as many co-operative banks on digital payment platform by making them interoperable with large banks. Sarvatra Technologies started with NFS, providing RuPay Debit and Kissan Credit Cards issuance and enabling transactions on ATMs, PoS and eCommerce. They are bringing sub-member banks on other NPCI platforms like IMPS, UPI, AePS and Bharat BillPay. The company not only on boards Urban Cooperative banks but also State Co-operative Banks and District Central Cooperative Banks which is helping in financial inclusion.