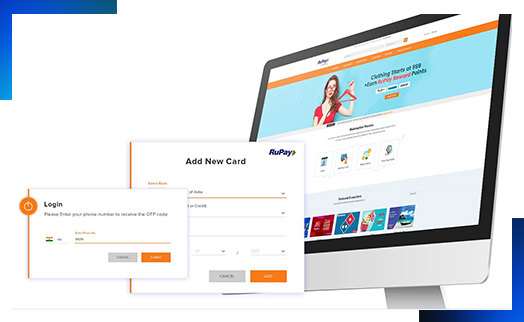

Launch of NPCI’s loyalty platform for offers and rewards across all the products

NPCI has launched its first-ever common platform for offers & loyalty program which serves as a dedicated platform to provide uniform eco-system for rewarding users with exclusive offers and privileges.

The platform has been built with the sole purpose of enabling NPCI’s partner banks to access a common platform for reward offerings where partner banks can create customized campaigns for customers depending on their choice of payment modes and payment schemes. This platform will provide a simple means to engage with partner banks’ customers, across multiple channels and touch points. Banks can also manage their stand-alone loyalty programs with end-to-end rewards capabilities with 1000+ merchant partners.

Recent launches:

RuPay Credit card launch

Kotak Bank – First bank to go live as Sponsor and Destination bank on both variants of Net Banking & Debit card on NACH API e-mandate

Kotak Mahindra Bank (Kotak) announced the launch of an industry-first debit card-based authentication solution on NPCI’s e-Mandate API platform. Kotak has become the first Destination Bank to go live with both Net Banking and Debit Card-based e-mandate authentication. This capability will enable Kotak customers to create electronic mandates (similar to the erstwhile eNACH with Aadhaar + OTP) via both the Debit Card and Net Banking channels. This milestone of being certified as a Destination or Issuer Bank now also allows Kotak to Go Live as a Sponsor / Acquirer Bank for corporates and merchants seeking recurring payments.

E-Mandates have a number of advantages over physical mandates, most notably in terms of security, costing, operational efficiency and turnaround time.

Online electronic mandates will work well across client segments such as Banking, NBFCs, Insurance, Utility Companies, Mutual Funds, OTT, E-commerce and Educational Institutions among others.

BOI NCMC Vertical Card Launch

Bank of India issued a total of 2.1 million NCMC vertical RuPay cards

BOI RuPay Platinum Credit Card Launch

PNB RuPay Rakshak Credit Card Launch

TranServ – first PPI to launch RuPay Cards

TranServ is the first non-bank PPI to launch interoperable payments in partnership with RuPay. The Prepaid card, launched under the Dhani Pay brand, not only comes with an attractive vertical card design but also offers 100% worth of gifts and shopping vouchers on all RuPay card spends – up to Rs. 60,000 p.a. The card comes with high level of security features which can be managed through the Dhani Pay mobile app. Customers have the option of applying for an instant loan from Indiabulls Consumer Finance Limited through the Dhani pay mobile app and if eligible, such amounts are instantly credited to the prepaid account and made available for use at over 3 million RuPay merchants across India.

CMRF Odisha – Cyclone Fani

Extremely Severe Cyclonic Storm Fani was the strongest tropical cyclone to strike the Indian state of Odisha since Phailin in 2013. The second named storm and the first severe cyclonic storm of the 2019 North Indian Ocean cyclone season, Fani originated from a tropical depression that formed west of Sumatra in the Indian Ocean on 26 April. Fani weakened before making landfall, and its convective structure rapidly degraded thereafter, degenerating into a remnant low on 4 May, and dissipating on the next day.

Option to pay via BHIM UPI was promoted and circulated across social media for contributions towards CM Relief fund where a massive contribution of over ₹ 2,54,56,817+ was received.

Launch of RuPay prepaid cards in association with SlicePay and Yes bank

Slicepay has launched RuPay Prepaid Card with Yes bank which helps in issuance of loans to Students/ Salaried & Home Makers via Slice Pay. Slice Pan is an NBFC offering Small Credits to Students up to Rs 60000 and has tied up with more than 300+ Colleges offering microloans SlicePay Card and Micro Cash Loans. These cards could be used for ECom & PoS Transactions & Repayment of the credit is done through UPI (Slice Pay App)