UPI is now a payment option for IPO applications

Unified Payments Interface (UPI) added another feather to its cap when NPCI in association with Securities and Exchange Board of India (SEBI), rolled out UPI as an alternative payment option for buying shares in a public issue (IPO).

The first IPO with UPI as a payment option was opened on 24th January, 2019 with

M/s. Xelpmoc Design and Tech. This was followed by another IPO of M/s. Chalet Hotels on 30th January, 2019. The new process shall increase efficiency, eliminate the need for manual intervention at various stages, and reduce the time duration from issue closure to listing by up to 3 working days (from the existing timeline of 6 days).

Some of the immediate benefits that UPI shall provide to the public issue listing process are:

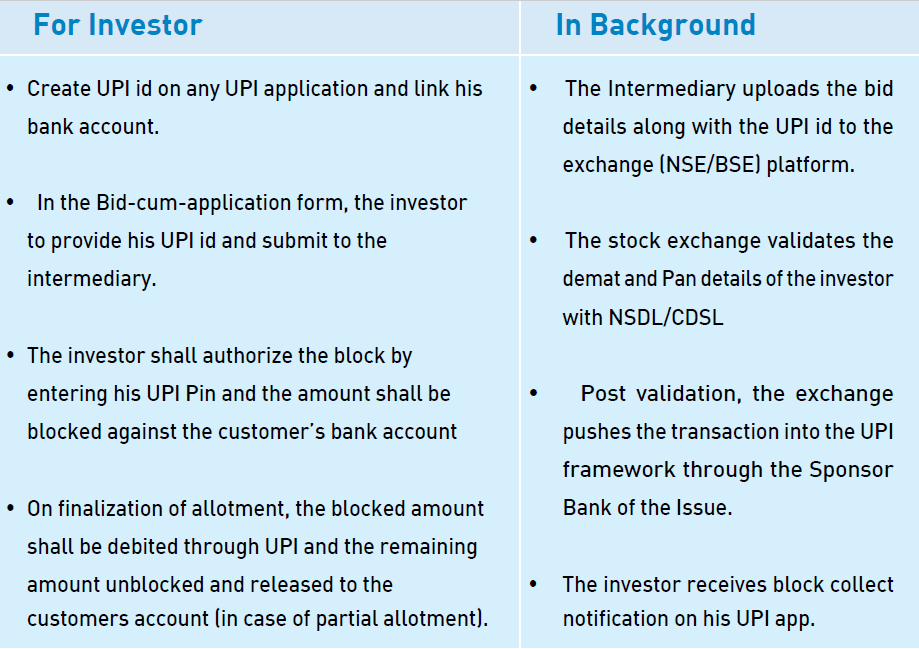

UPI payment process in IPO explained

Product milestones

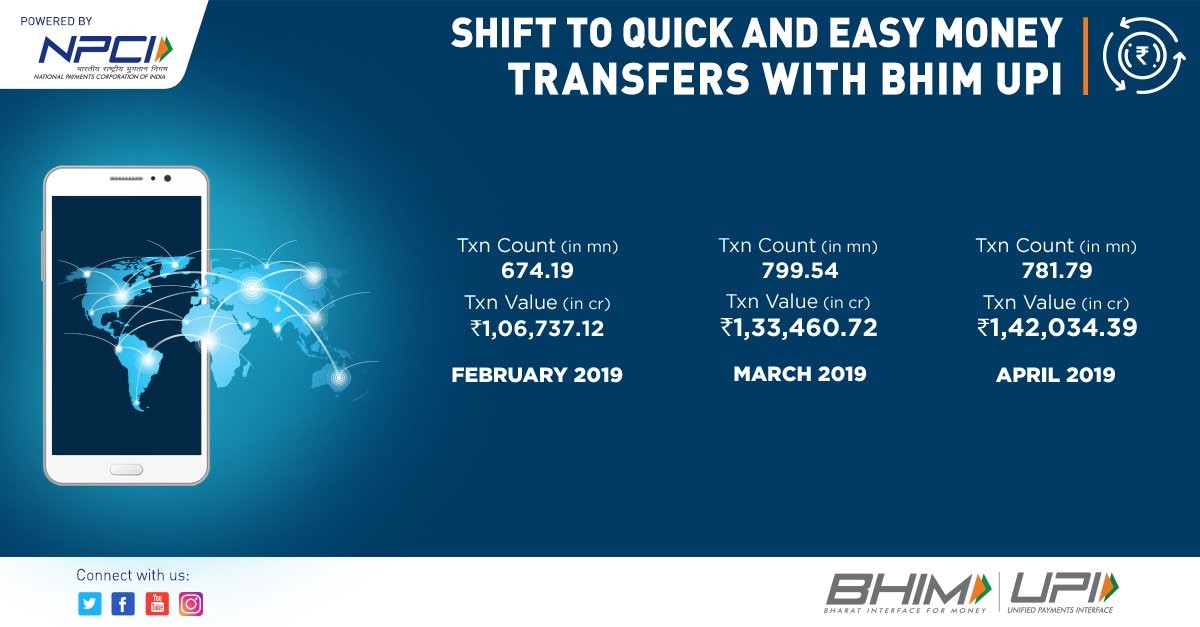

BHIM UPI

IMPS

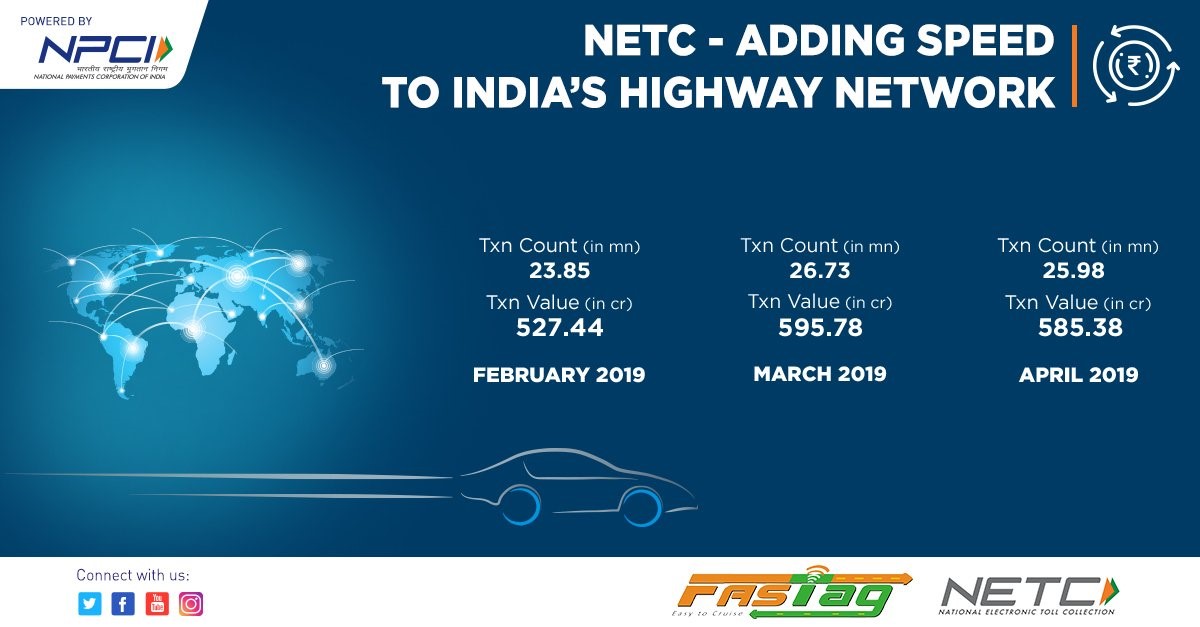

NETC

AePS