UPI is now a payment option for IPO applications

Unified Payments Interface (UPI) added another feather to its cap when NPCI in association with Securities and Exchange Board of India (SEBI), rolled out UPI as an alternative payment option for buying shares in a public issue (IPO).

The first IPO with UPI as a payment option was opened on 24th January, 2019 with M/s. Xelpmoc Design and Tech. This was followed by another IPO of M/s. Chalet Hotels on 30th January, 2019.The new process shall increase efficiency, eliminate the need for manual intervention at various stages, and reduce the time duration from issue closure to listing by up to 3 working days (from the existing timeline of 6 days).

Some of the immediate benefits that UPI shall provide to the public issue listing process are:

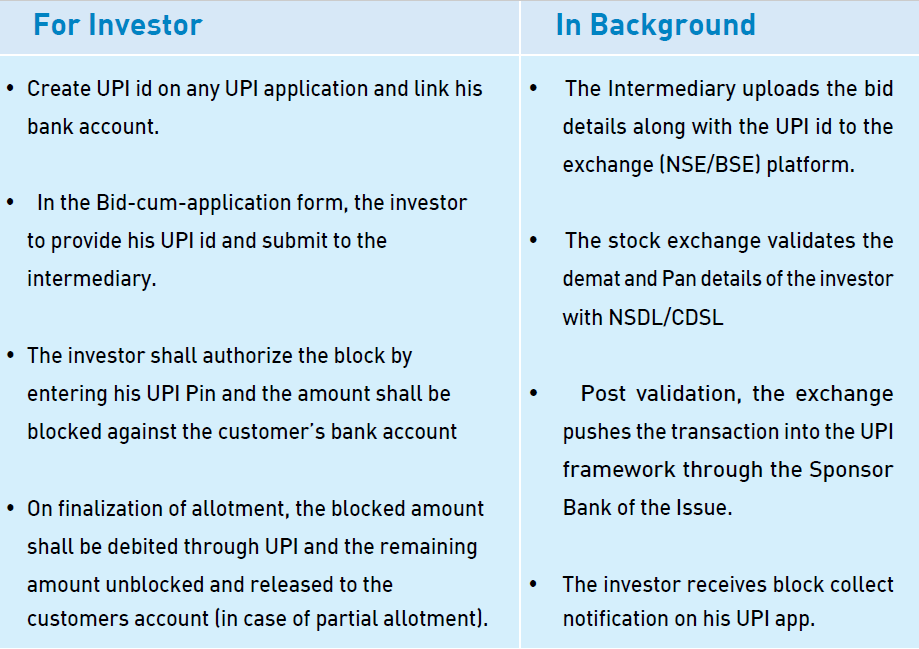

To illustrate;

i. UPI as an option shall eliminate the need for segregation of Bid-cum application forms basis the investor banks and sending it to the respective bank locations.

ii. Manual verification of the customer’s signature on the application form is done away with as the same is substituted by the customer authorizing the block by entering his UPI PIN on receiving the block collect request from the exchanges.

iii. The Registrar in this process shall co-ordinate with a single entity, the Sponsor Bank, for collating the details of the total block details and execution of allotment as against the extant process where the Registrar follows up manually with all the SCSBs manually.

Phase wise implementation of UPI as a payment option.

As this is a new change in the IPO application for retail investors, SEBI has decided to implement UPI as a payment option in three phases:

Phase I

Starting 1 January 2019, the UPI mechanism will be made available to retail investors but the existing process of submitting physical applications from intermediaries to banks will also continue. IPO listing timeline will continue to be T+6 days. This phase will remain in place for three months but can extend to accommodate at least five mainboard IPOs.

Phase II

In the subsequent phase, UPI payment for IPO will be made mandatory for retail investors and the movement of physical forms for blocking of funds will be discontinued. Nevertheless, the gap between IPO closing and listings will remain T+6 days.

Phase III

In the final stage, the gap between IPO closing and listing will be reduced to three days.

UPI payment process in IPO explained

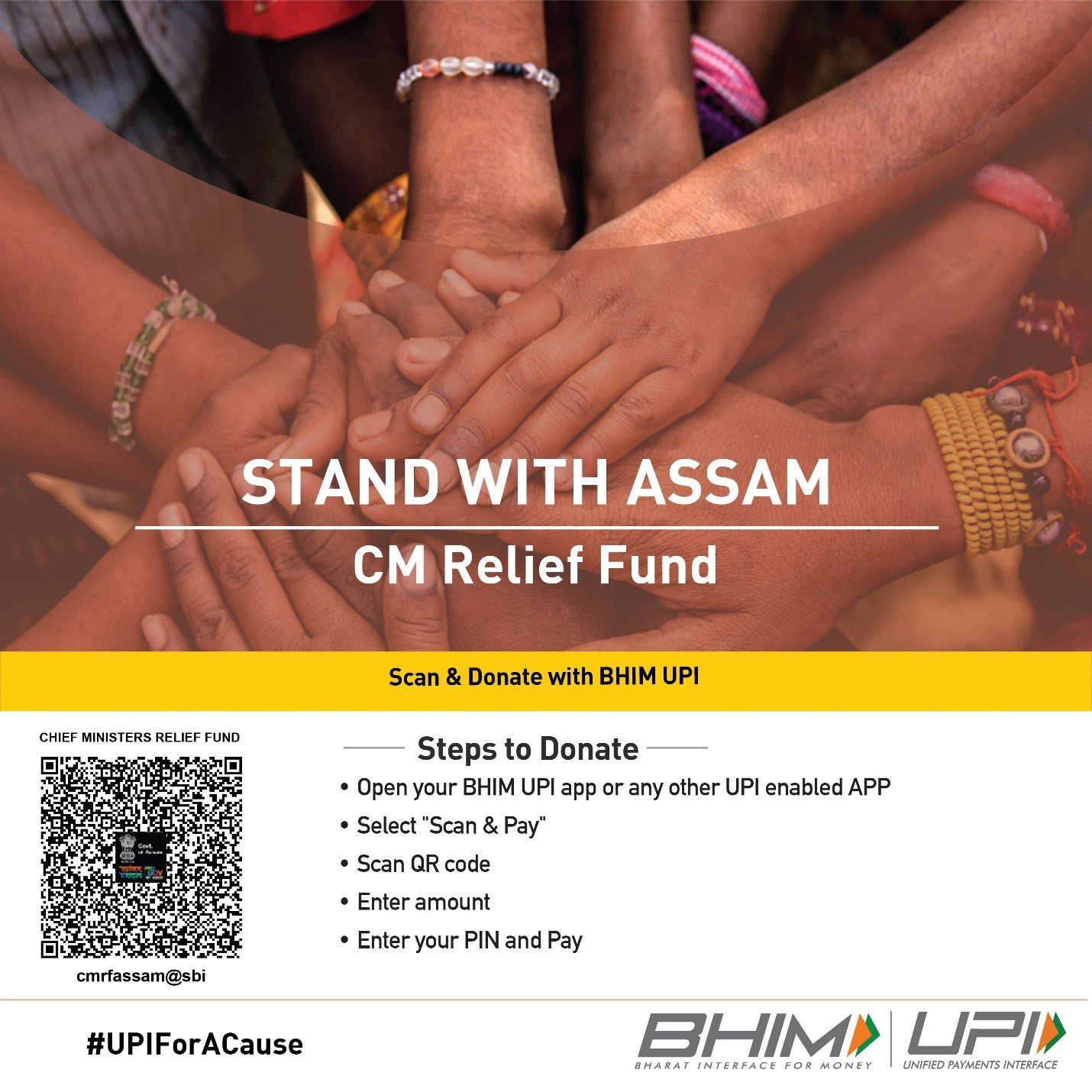

Chief Ministers Relief Fund – Assam

Due to current Floods in Assam, a lots of lives have been affected for which the CMRF Assam team had called out for a support for contributions/donations towards the fund.

NPCI in association with CMRF Assam and SBI had enabled the BHIM UPI QR code for Assam and which was promoted through the social media channels and through CMRF Assam website.

Product milestones

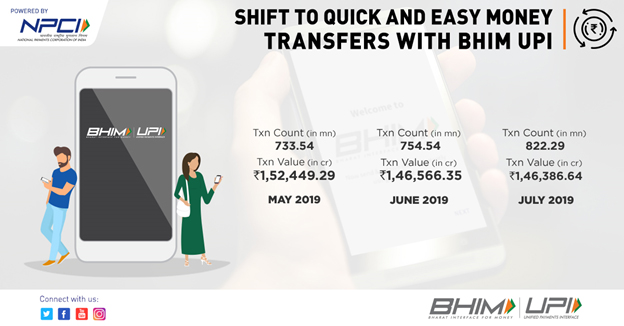

BHIM UPI

IMPS

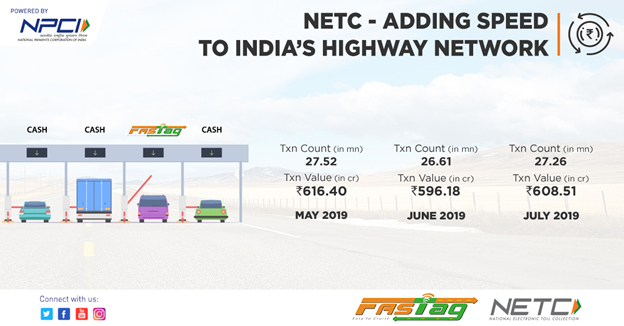

NETC

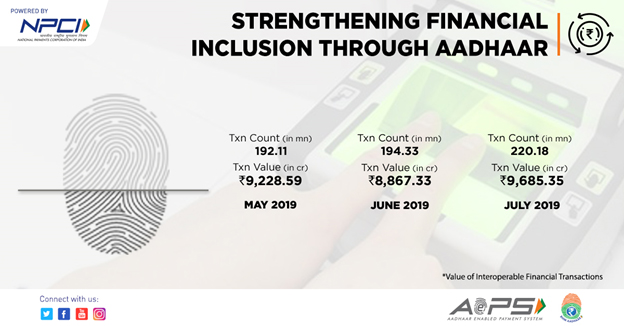

AePS