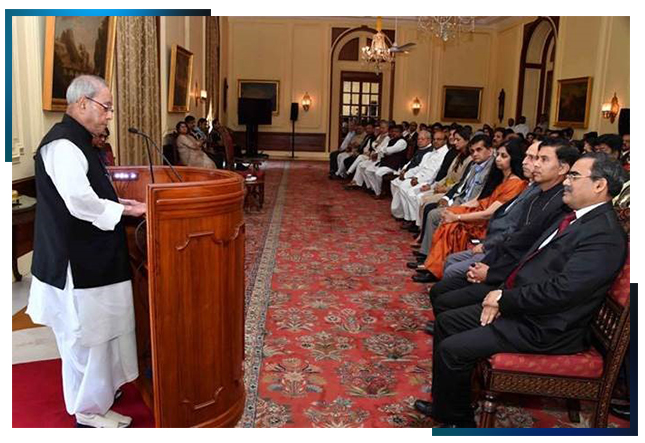

President concludes lucky draw scheme with 100th Mega Draw

Hon’ble President of India, Shri Pranab Mukherjee picked up the lucky winners from the 100th mega draw for Lucky Grahak Yojana and Lucky Vyapaar Yojana at the Rashtrapati Bhavan on April 9, 2017. He congratulated those who are contributing towards achieving the mission of making India a less-cash society. He articulated that the launch of Bharat Interface for Money (BHIM) has demystified the digital payments and brought it within the grasp of every citizen. President urged all citizens to extend their unstinted support to the mission of a less-cash India.

PM Modi launches AePS enabled BHIM App

Hon’ble Prime Minister Shri Narendra Modi launched an Aadhaar enabled BHIM App for merchants in Nagpur on April 14, 2017. At the launch ceremony, PM Modi articulated that BHIM App’s success will be a global case study in the future. Customers will be able to transact digitally by simply using their fingerprint for authentication through BHIM Aadhaar platform. One does not require a smartphone, internet or cards to make seamless digital transactions through BHIM Aadhaar. In his speech, PM Modi mentioned that the time is not far when premise-less and paperless banking will become a part of people’s lives.

BHIM Aadhaar works on NPCI’s existing product - Aadhaar Enabled Payment System (AePS). It allows the customer to make purchases using their Aadhaar number linked with their bank account. BHIM Aadhaar would be applicable for retail merchants (individuals and sole proprietors) only and not for corporate merchants.

NPCI has extended support to the banks mentioned below for BHIM Aadhaar on-boarding as on April 14:

- Public Sector Banks and Private Banks

Allahabad Bank, Andhra Bank, Axis Bank, Bank of Baroda, Bank of India, Canara Bank, Central Bank of India, City Union Bank (Issuer), Corporation Bank, Dena Bank, Federal Bank (ONUS), HDFC Bank, ICICI Bank, IDFC Bank, Indian Bank, IndusInd Bank (Acquirer), Indian Overseas Bank, Oriental Bank of Commerce, Punjab National Bank, Punjab & Sind Bank, State Bank of India, South Indian Bank (Issuer), Syndicate Bank, UCO Bank, Union Bank of India, United Bank of India and Vijaya Bank.

- Regional Rural Banks (all are issuers)

Kerala Gramin Bank and Pragathi Krishna Gramin Bank sponsored by Canara Bank, Chaitanya Godavari Gramin Bank sponsored by Andhra Bank, Baroda Gujarat Gramin Bank sponsored by Bank of Baroda, Andhra Pradesh Gramin Vikas Bank sponsored by State Bank of India.

NPCI’s BHIM App hits Google PlayStore and iOS with updated version

Bharat Interface for Money (BHIM), the common platform across the nation for making simple, easy and quick payment transactions using Unified Payments Interface (UPI) is now available on Google Play Store and iOS with an updated version

1.3. Key features of the latest version (BHIM 1.3) are:

Three new languages: Marathi, Punjabi and Assamese have been added to BHIM application. Total number of languages in BHIM app now stands at 12.

Use phone contacts to send money: Customers can now browse the contact list of their phones to select beneficiaries for sending money. This is applicable to mobile numbers of users who are already registered with BHIM / *99#.

Enhanced QR feature: With the new version, users can browse QR code which is saved in their mobile phones to Scan and Pay. Apart from these key updates, upgraded BHIM app has made possible blocking / un-blocking to prevent unknown collect requests.

BHIM consumer referral scheme gains momentum

The BHIM referral bonus schemes for consumers implemented by NPCI and launched by Hon’ble Prime Minister, Shri Narendra Modi has started gaining momentum in the country. The scheme was launched on April 14, 2017 on the occasion of commemorating the 126th birth anniversary of Dr. Bhimrao Ambedkar. The objective was to encourage the use of digital payments by way of rewarding the referrer and the referee. The total targeted outlay by the Government of India for rewarding the referee and referrer is Rs. 495 crores for a period of six month (from April 14, 2017 to October 14, 2017). The scheme is administered by MeitY.

BHIM App encourages digital payments

NPCI’s common UPI App called Bharat Interface for Money (BHIM) which was launched by Hon’ble Prime Minister Shri Narendra Modi on December 30, 2016 is available on Google PlayStore for Android customers and iOS for iPhone users. New version of the BHIM App will cover features like new regional language, split bills facility etc. It will also integrate Bharat QR code based payments. PM Modi had launched BHIM referral bonus scheme for consumers on April 14, 2017 which is gaining momentum in the country. The objective is to encourage the use of digital payments by way of rewarding the referrer and the referee.

More banks join Unified Payments Interface platform

National Payments Corporation of India (NPCI) is proud to announce that the revolutionary Unified Payments Interface (UPI) is offered by about 50 banks in the country. Recent banks to go live as issuers on the platform are: Thane Bharat Sahakari Bank, ApnaSahakari Bank, Janata Sahakari Bank, The Mehsana Urban Co. Op. Bank and Vasai Vikas Sahakari Bank.

About 20 per cent UPI volume are from merchant category

Merchant transactions contribute to about 15-20 percent in daily volume of Unified Payments Interface (UPI) Top UPI enabled merchants are Paytm, PhonePe, Myntra, Flipkart, LIC, IRCTC, RedBusetc while BillDesk, Razorpay, CCAvenue, PayUmoney and Citrus Pay are the top five aggregators on UPI. Number of merchants accepting UPI are set to increase considerably over the next few months.

IMPS ecosystem grows to 236 member banks and PPIs

About 211 banks and 25 Prepaid Payment Instruments are part of Immediate Payment Service ecosystem. The service is being offered by 27 public, 20 private and six foreign banks. There are about 30 Regional Rural Banks and 6 Co-operative banks live on the platform. In addition to that IMPS caters to the customers of one Payments Bank and four Small Finance Banks

MD & CEO conducts session at IAS Academy

A session on theme ‘Digital Payments: Towards Cashless India’ was conducted by Mr. A. P. Hota, MD & CEO at Lal Bahadur Shastri National Academy of Administration in Mussoorie on May 9, 2017.

Cash-Lite cities

Over 50 teachers of GraminShiksha Kendra in Sawai Madhopur city, Rajasthan were familiarised with products and services of NPCI through a workshop on May 26. This workshop was conducted with an aim to share significance of digital payments to about 500 government school teachers and over 10,000 parents of students in near future.Financial Literacy and Advisory Services vertical of NPCI is working to provide assistance to with required training materials, technical support and monitoring mechanisms for creating cash-lite city. Currently the project is implemented in two blocks of the Sawai Madhopur district which shall be expanded to another three districts.

Financial Literacy and e-BAAT workshops

A workshop to create awareness on Direct Benefit Transfers and Bharat Interface for Money (BHIM App) was organised for senior government officials in Gandhinagar, Gujarat. NPCI officials delivered a presentation on the services offered by the organisation. In a similar event, representatives from NPCI conducted ‘e-Baat’ program for over 80 participants in Ahmedabad in May 2017 to share insights of digital payments products offered by the company.

NPCI bags India Innovation Awards 2017

NPCI was felicitated with an award for creating an impact based learning under Government / PSU category at the 2017 India Innovation Awards.