Ashutosh Dubey, Lead Business Analytics and Innovation - NPCI

IndiaStack refers to the universal suite of Open API program along with biometric identity program Aadhaar, there are four distinct layers which has been expected to play a crucial role in India’s digital foundation and evolution. These are

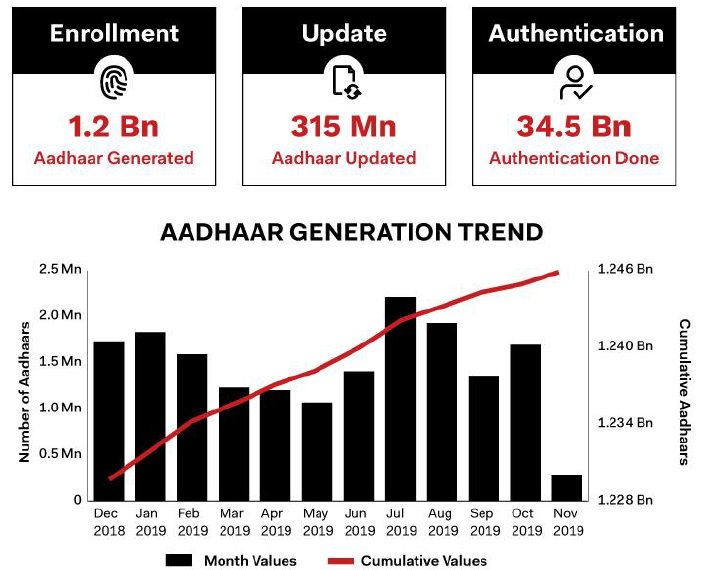

1. Presenceless Layer

This is the capability of being authenticated from anywhere. Aadhaar is used as Identification utility and an enabler for authentication. This unique ID offers people a digital identity and enables them to provide their identity proof anytime, anywhere, without having to carry any physical documentation Using Aadhaar, an individual would only need to remember the 12-digit unique number and identify his or her authenticity with a simple finger scan (iris scan is also available as a mode) Aadhaar has been created to be robust enough to eliminate duplicate and fake identities

Source: Medici Report

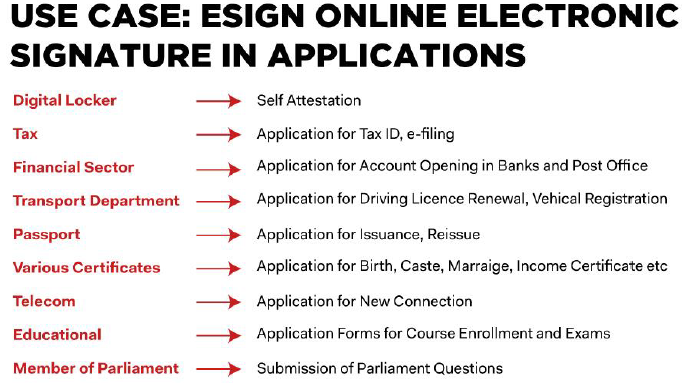

2. Paperless Layer

This refers to the reliant on digital records. It comprises of Aadhaar eKYC, eSign, and Digital Locker. Provides the ability to Store & Retrieve Data digitally. These solutions enable a paperless ecosystem that verifies, stores information and documentation digitally and authenticate anytime and across any device.

Source: Medici

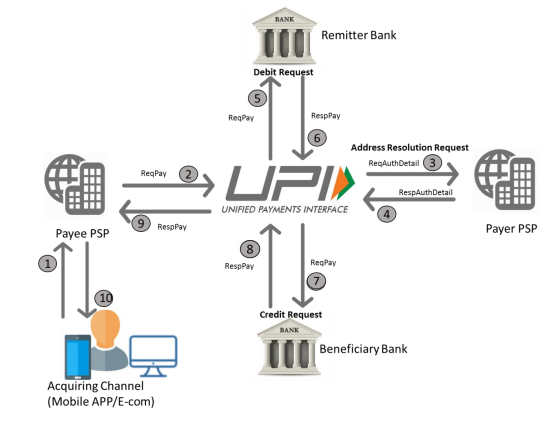

3. Cashless layer

This truly universalizing the access and usage of digital payments; and NPCI is the owner of this Layer. The objective of this layer is to move things into the digital age, payments, and financial transactions need to go cashless, enabling transparency and ease of use Unified Payment Interface plays a key role in this layer with it API enabled ecosystem. UPI allows people to transfer money from any bank account to any other bank account (individuals or merchants) digitally, securely, and instantly by simply creating a VPA (Virtual Payment Address) without going through circuitous steps online or offline.

Source: NPCI

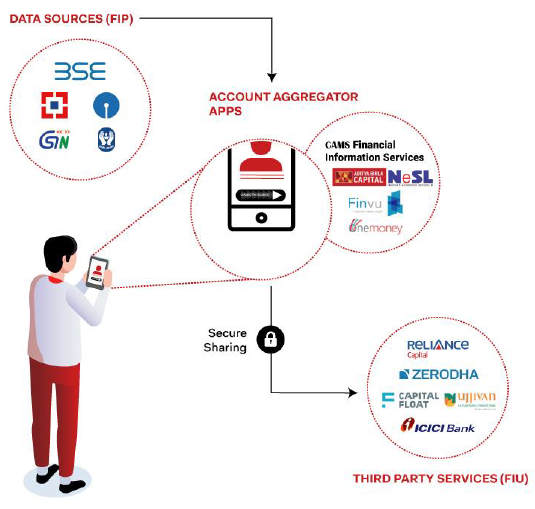

4. Consent Layer

This allows the secure movement of data authenticated by its owners. The electronic consent architecture enables user controlled data sharing, data flow, and data retention This layer allows data to move freely and securely to democratize the market for data. Biggest beneficiary of this facility will be Account Aggregator Ecosystem. Illustration of how consent layer will enable AA ecosystem is in the diagram with a thin data aggregation layer provided by AA between FIP and FIU.

Source: Medici Report

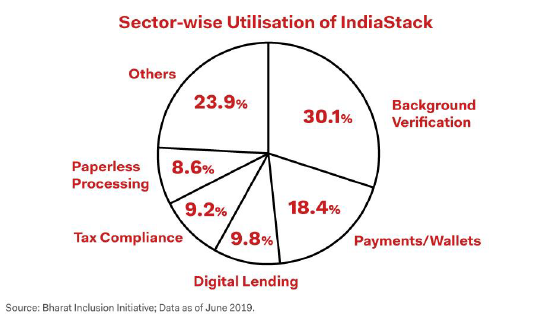

In the end let us visit the utilization of IndiaStack across multiple business areas. This depicts the role of India stack is majorly on Background verification and EkYC, however upcoming trends of Digital Lending, Open Banking and Account Aggregator will popularise the India Stack and enable the Fintech to roll out innovative products with lesser Turn round Time. Please share your views on how India stack can help growing the Indian Fintech Ecosystem at innovations@npci.org.in and our social media handles - Twitter, Linkedin

Source: Medici Report on India Stack | UPI Procedural guidelines| Indiastack.com