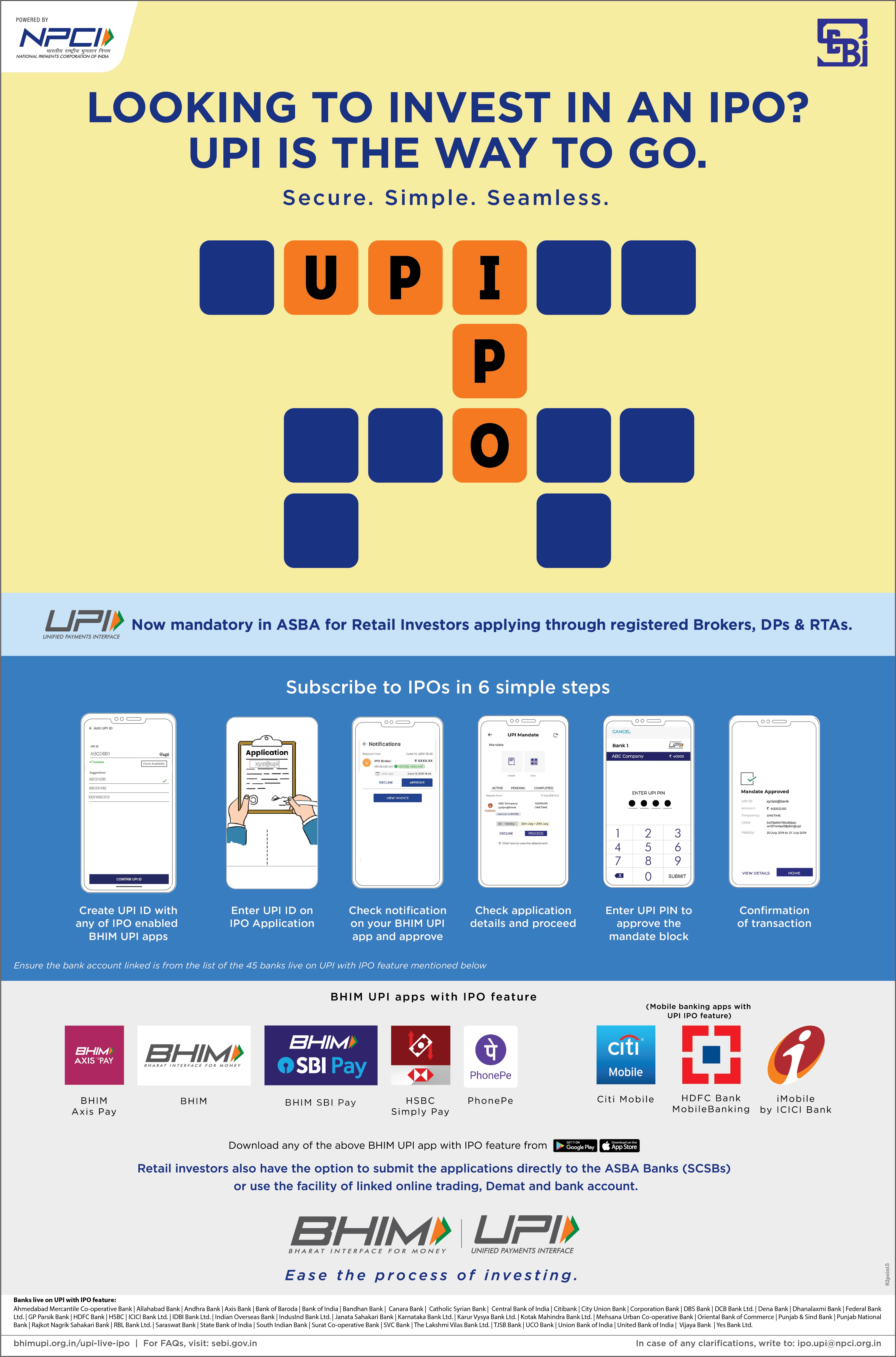

UPI is now a payment option for IPO applications

Unified Payments Interface (UPI) added another feather to its cap when NPCI in association with Securities and Exchange Board of India (SEBI), rolled out UPI as an alternative payment option for buying shares in a public issue (IPO).

Some of the immediate benefits that UPI shall provide to the public issue listing process are;

National Payments Corporation of India (NPCI), announced rationalization of Merchant Discount Rate (MDR) for RuPay Debit Card transactions across Point of Sale (PoS), eCom and BharatQR Code based merchant transactions. The significant reduction in MDR is aimed at creating a cost effective value proposition for all stakeholders in the payments ecosystem thereby increasing merchant acceptance footprint across the country. This will support merchants to accept hi-value digital payments from the 830 mn debit cards.

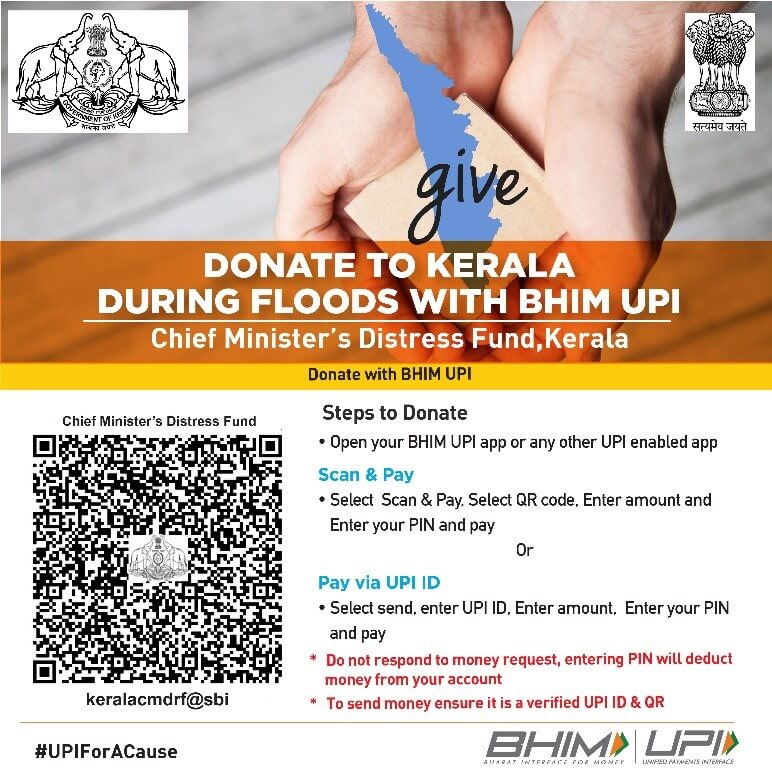

Due to current Floods in Bihar, Karnataka, Maharashtra and Kerala a lots of lives have been affected for which the CMRF team had called out for a support for contributions/donations towards the fund.

BhIM UPI

IMPS

AePS

NETC