-Deep Shah, Lead AEPS, NPCI

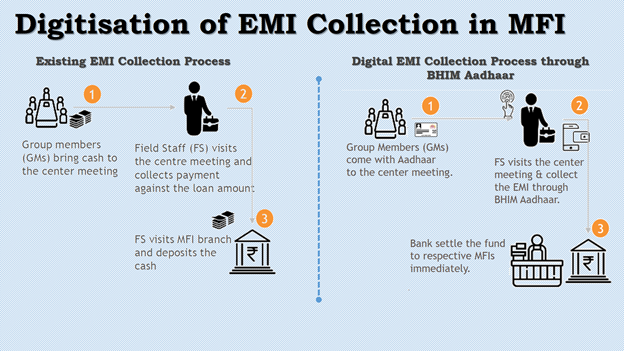

Currently in MFI sector more than 87%of MFIs’ Loan disbursements are happening through cashless channel but less than 10% of EMI collections are happening through digital channel and leaving 90% of EMI collections in cash.

Cash intensive models have their own challenges. It increases operational cost of the MFI companies. The traditional cash intensive model of MFIs poses many risks and challenges such as:

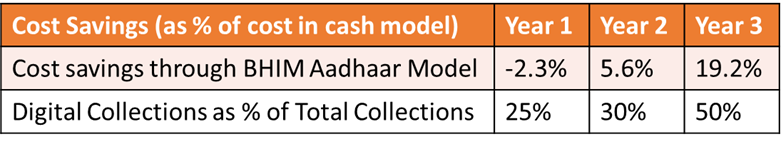

NPCI has conducted a study with MicroSave Consulting to derive the cost-benefit analysis of going digital for EMI collection. Further, analysis suggests that the transition to cash-lite repayment provides cost and time savings for MFIs in the medium run with benefits getting added rapidly over the long run. MFIs can generate more business with the saved time by shifting to cash-lite repayments. Please find the table which represents benefits yield out of digitisation:

The study shows that BHIM Aadhaar is one of the best choice for digital EMI collections for MFIs working in rural areas. As per M-Fin data, 75% of the customers of MFI are located in rural India. In rural parts of India, more than 35 Cr+ people are aware about usage of Aadhaar as a payment instrument through AePS. In order to keep the repayment rate higher, most of the MFIs don’t want to shift their process. They want a product to which create synergy with the existing processes. An agent can still visit clients & make the repayment with BHIM Aadhaar [A smartphone & biometric device (IRIS/Fingerprint)]. Above table shows how digital repayment can assist MFIs to reduce their operational cost.

Non-fungible token (NFT) and why are they gaining attention

- Ashutosh Dubey, Lead Business Analytics, NPCI

In economics, a fungible asset is something with units that can be readily interchanged - like money. Recently, a digital-only artwork was sold at Christie's auction house for an eye-watering $69m (£50m) - but the winning bidder will not receive a sculpture, painting or even a print. Instead, they get a unique digital token known as an NFT, where Cryptocurrency was hailed as the digital answer to currency, NFTs are now being seen as the digital answer to collectables. In the word of Ethereum, the ERC-721 tokens are Non-fungible tokens (NFTs). This implies that each token has a unique set of properties and values associated with it. Being unique makes ownership more desirable, especially in the case of highly sought after tokens.

There are multiple functions that enable interaction with NFTs such as:

ERC-721 tokens have found applicability in many domains of the Ethereum space, the most relevant being the following:

Just to explain the comparison between Fungible and Non-fungible Tokens:

| Fungible Tokens ( Currency/Payment Instrument) | Non-fungible Tokens (Physical/Digital Assets) |

|---|---|

| Fungible are Interchangeable

-Tokens are interchangeable and can be exchanged with any other token of the equivalent kind. |

Non-fungible are Non-Interchangeable -Tokens are non-interchangeable as they cannot be replaced with the non-fungible token of the same type. |

| Fungible Tokens are Divisible

-These tokens can be divisible into smaller units, and one can get any number of units, and it does not matter to holders as long as the value remains the same. |

Non-fungible Tokens are Non-Divisible -These tokens cannot be divided in any sense. |

| Fungible Tokens are Uniform

- Each token is different from all other tokens of the same type. |

Non-fungible ones are Unique -All tokens of each type are identical in specification, and each token is identical to each other. |

| Holds Value | Holds Data |

| Value transfer depends on the number of tokens an owner possesses. | Value transfer is based on the unique value that a token possesses. |

In theory, anybody can tokenise their work to sell as an NFT but interest has been fuelled by recent headlines of multi-million-dollar sales. On 19 February, an animated GiF of Nyan Cat - a 2011 meme of a flying pop-tart cat - sold for more than $500,000. A few weeks later, musician Grimes sold some of her digital art for more than $6 mn. It is not just art that is tokenised and sold. Twitter's founder Jack Dorsey has promoted an NFT of the first-ever tweet, with bids hitting $2.5 mn. Christie's sale of an NFT by digital artist Beeple for $69m (£50m) set a new record for digital art. But as with crypto-currencies, there are concerns about the environmental impact of maintaining the blockchain.

Disclaimer – This is to inform readers that the views, thoughts, and opinions expressed in this article belong solely to the author, and not necessarily to the author's employer, organisation, committee or other group or individual.