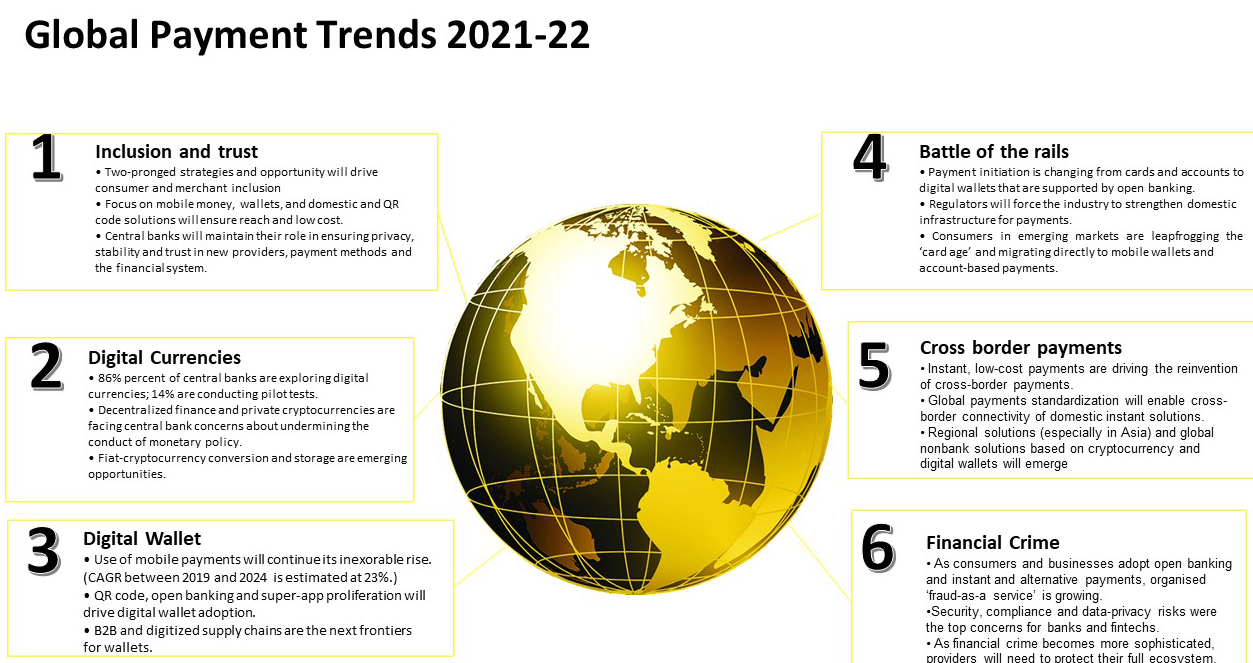

Source: PWC

FinTech - The Driver of (Digital) Transformation across BFSI Sector during Pandemic

- Ashutosh Dubey, Lead Business Analytics and Innovation, NPCI

The pandemic has increased the momentum of digitisation supported by the regulatory framework and policies of the government. The unbanked, under-banked, and financially vulnerable people—that’s where a lot of fintech efforts have been oriented, but broadly it does affect the entire financial services system and all of its users. Established FIs have been forced to expedite their digitalisation plans to meet new demands. As their infrastructure needs have evolved, automation and other digital services have become more important, with FinTechs ready to deliver innovative solutions. Indeed, the industry is no stranger to crisis. The FinTech wave emerged primarily from the chaos caused by the 2007/08 global financial crisis (GFC). Uncertainty breeds innovation, and in the wake of the GFC, FinTech attracted significant investment and began to revolutionise financial services. COVID-19 presents another opportunity to advance this legacy.

The fiscal year 2020 was a blockbuster year for the fintech ecosystem for several reasons. Not only did the pandemic encourage consumers across the board to adopt digital payment channels and financial services in a big way, but it also drove massive funding towards the ecosystem. At the same time, the past year also forced traditional financial institutions to face their shortcomings in the digitally enabled world with massive system failures that forced the Reserve Bank of India (RBI) to pull them up for not being technology ready. At a systemic level as well, banks have been increasingly challenged to change their traditional operating models for a post-pandemic world. These changes require technology overhauls and a change in how they work and who they work with. It is not surprising that RBI, in its annual report, stated that the next phase of job growth in the ecosystem will come from fintech.

Doing so will help to mitigate the economic and social impact of the pandemic. According to Deloitte, FinTechs, in strategic partnerships with financial institutions, retailers and government sectors across jurisdictions, can help democratise financial services by providing basic financial services in a fair and transparent way to economically vulnerable populations. Digital onboarding has risen substantially with more people exhibiting a behavioural shift towards digital modes of payment. The last 12 months have seen a kind of growth in digital payments that might’ve happened over the next 3-5 years, under normal circumstances. As per RBI’s Annual Report 2020-21, the payment systems recorded a robust growth of 26.2% in terms of volume on top of the expansion of 44.2% in the previous year. Overall, the total digital transaction volume in 2020-21 stood at 4,371 crores, as against 3,412 crores in 2019-20, attesting to the resilience of the digital payment system in the face of the pandemic. The nation is also witnessing the growing confidence among consumers towards digital payments not only in tier I and II cities but also in tier III and beyond.

India was home to the highest number of real-time online transactions in 2020 ahead of countries such as China and the US. 25.5 billion real-time payment transactions were processed in India followed by 15.7 billion in China, 6 billion in South Korea, 5.2 billion in Thailand, and 2.8 billion in the UK. The transaction volume share for instant payments in India, among real-time transactions, was 15.6%, whereas 22.9% for other electronic payments in 2020. As per ACI worldwide report, Digital Payments in India to grow to 71.7% of all payment transactions by 2025. NPCI along with RBI, the Government of India, and ecosystem partners have been working towards a common goal of achieving a less-cash, more digital, financially inclusive society in India. A recent study conducted by NPCI and PRICE, revealed that 36% of households surveyed used digital payments for the first time during the lockdown. The enhanced value proposition of convenience and user experience has made digital payments popular among the masses. Modern fintech players have also stepped up to empower customers with seamless, hassle-free, and contactless payment mechanisms. Moreover, the Central Government is constantly encouraging consumers to adopt digital payments. All these factors when combined, indicate that the future of payments is heading towards digital, and slowly but steadily inching towards making it a necessity. Thereby accelerating India to rise as a digital-first economy in the post COVID era. Given the rising reliance on technology, digital transformation will be a primary focus for FIs in the months and years ahead. Whereas previous efforts to integrate technology may have been limited in scope, many FIs are awakening to the fact that in order to deliver an efficient, effective and sustainable banking service, they must adopt a more holistic approach to digital transformation, which includes utilising FinTech.

An example of how the HR ecosystem sees fintech evolving to accommodate traditional BFSI roles is the increasing number of fintech startups that are offering marketplace-like platforms for fintech advisors in addition to robo-advisors. The existing knowledge base of insurance agents, financial advisors and salespersons in this ecosystem will continue to be relevant, only that it will be increasingly accessed online.