Framework for Cross-border Instant Payments

- Ashutosh Dubey, Lead Business Analytics, NPCI

The trillion-dollar cross-border payments sector is ripe for disruption due to changing customer demands, emerging market growth, and financial inclusion. New specialised players are challenging the dominance of incumbent banks by offering innovative solutions to traditional pain points. Responding to market shifts will require new competitive strategies, which may include acquisitions and collaboration.

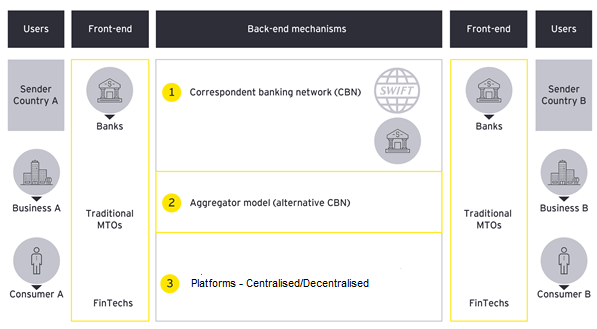

Cross-border payments are currency transactions between people or businesses that are in different countries. The money sender typically will choose a front-end provider, such as a bank or a money transfer operator, to initiate the payment. The receiver then receives the payment via the medium specified by the sender. Traditionally, cross-border payments flow via the correspondent banking network (CBN), which most front-end providers use to settle the payment. But, in recent years, we’ve seen new back-end networks emerge to optimise cross-border payments and enable interoperability between payment methods and provide senders with more possibilities to reach the receiver.

The current challenges in the Cross-border payments:

Thus, it is important to work towards these challenges and come up with holistic, cheaper, transparent and reliable solutions which can not only address these challenges but also make a bigger market for Global E-commerce.

In many countries today, domestic payments between bank accounts happen in seconds, at near-zero cost, thanks to the growing availability of instant payment systems (IPSs). In contrast, cross-border payments between accounts in two countries can be slow, complicated and expensive, depending on the service used. IPSs enable domestic account-to-account payments, with the recipient being credited in real-time (or near-real-time) on a 24/7 basis. They are operational in around 60 countries, and underdevelopment in more. Recently, BIS (Bank for International Settlement) along with NPCI (National Payment Corporation of India) and MAS (Monetary Authority of Singapore) has come up with a framework – Nexus. This BIS Innovation Hub project - Nexus explores a framework to build a cross-border payment network leveraging IPS to improve the cross-border payment experience. In this article, just want to highlight the blueprint published for a scalable cross-border payments network.

Nexus overcomes the complexity of linking IPSs on a country-to-country basis by providing a standardised way for domestic payment systems to speak to each other. This enables “interoperability” between payment systems.

Nexus includes two main elements:

So what as an end-user, I can expect if such framework is adopted by global IPS: