Digital Banks & Overview of the proposed regulation in India

- Ashutosh Dubey, Senior Lead Business Analytics, Market Innovation

Background

The Nachiket Mor Committee Report (“Committee”), released in 2014 has given salient recommendations of the Committee on differentiated banking policy, ie. issuing specialised bank licenses that would harness narrow specialisation along a given dimension rather than have every bank do everything and pursue every opportunity on both sides of its balance sheet. This leads to the emergence of Payment banks and Small finance banks licenses provided by the Reserve Bank of India (RBI). Payment banks are essentially narrow banks that issue deposits and earn income from high quality liquid assets and fees from distribution, aimed at furthering financial inclusion. While Small Finance Banks are envisaged to leverage technology to increase coverage and financial deepening. They have to maintain at least 50 % of the loan portfolio in ticket size of ₹ 2.5 million and below and also 75% of the credit to sectors identified as a priority sector.

However, a substantial fraction of these 63.88 million remain outside the ambit of formal finance and there is continued reliance on informal money markets like money lenders (quick disbursal without documentation) or chit funds (delayed disbursal but lower interest rates than money lenders) to finance itself, even at the cost of staying uncompetitive owing to the usurious interest burden. Also, there are several supply-side constraints faced by Brick and Mortar (existing banks in India). Firstly – the cost of credit.

The cost of issuing credit is very high in India. The average buffer of state-run banks between pre-provision profits and credit costs is only 160 basis points (bps) versus private banks at 340 bps. While MFI sector's credit cost estimate range for FY22 to 5-10 per cent from 3-6 per cent, depending on the geographies of operations/concentration.

Secondly, lack of product innovation - Private players, Fintechs, and ig techs are rapidly capturing the innovation gap from traditional banks by launching mobile and API-first platforms to take banking services.

Thirdly, limited underwriting capability - as per current regulations and push from the government for priority sector lending. There is limited credit with traditional banks to provide for innovative areas and sectors which seems promising to them.

Finally, low-risk appetite – Due to the emergence of NPAs and several watchdogs continuously monitoring the credit disbursements at Banks, the appetite is going smaller and smaller to issue credit.

Appetite to digital-first in India is also very high. This is visible with the growth of mobile users growth in India which is growing at 14 per cent year-on-year . Also, Indian consumers are spending almost five hours a day on mobile apps. Another key statistic is the growth of UPI (unified payment Interface) digital payments which are mobile-driven, it is touching $100 billion worth of transactions in October and November 2021. Thus, in order to fill the gaps and improve the financial inclusion index which was 53.9 by the end of March 2021, and get along with the digital-first appetite of Indians, there is a need for specified banking that will be digital-first and leverage technology as a medium to deliver service efficiently, effectively and securely.

Digital Banks

According to the recent NITI Aayog report 2021, “Digital Banks” or DBs referred to in this paper means Banks as defined in the Banking Regulation Act, 1949 (B R Act). In other words, these entities will issue deposits, make loans and offer the full suite of services that the B R Act empowers them to. As the name suggests, however, DBs will principally rely on the internet and other proximate channels to offer their services and not physical branches. Incumbent commercial banks have inefficient business models as evidenced by the high cost to income, and high cost to serve numbers. Banks and Fintechs offering digital banking services (so-called, neo-banks) rely primarily on digital channels that organically have high-efficiency metrics relative to incumbent commercial banks. This structural feature makes them a potentially effective channel through which policymakers can achieve social goals like empowering the hitherto under-banked small businesses and enhancing trust among retail consumers.

Three models of these “challenger banks” (so-called because of their emergence in the aftermath of the global financial crisis) appear to have emerged globally.

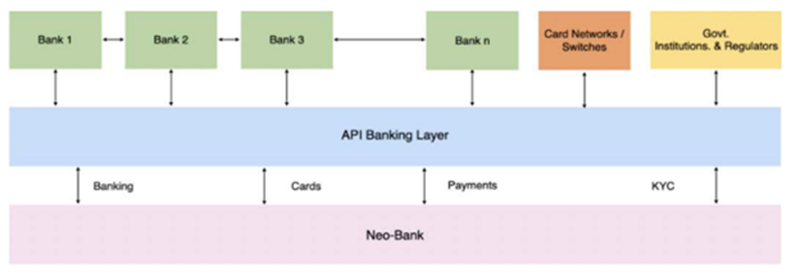

(Front-End Only) Neo-banks: These neo-banks partner with incumbent licensed banks to offer “over-the-top” services to the consumers “renting” the balance sheet of a bank (properly so called) to lend and issue deposits from banks (Open Technologies, RazorPayX, & Dave).

Full-Stack (Licensed) Digital banks: These entities are fully functional banks, regulated by the banking regulator, and issue deposits and make loans on their balance sheet. (Starling, Webank, Kakao, Monzo & N26)

(Autonomous) unit of traditional banks: These entities are essentially neobanking operations of traditional banks that function autonomously and compete with stand-alone neo-banks. (Marcus,25 (Goldman Sachs), 811 (Kotak Mahindra Bank), and Yono (State Bank of India).

Regulatory propositions in India

Key challenges identified for Open banks in India are Limited revenues based on acquisition charges and annual maintainece, technical and functional integration with existing core banking systems of partners, concern over data security and privacy thus inhibiting customer adoption, data sharing regulations, etc.

The recent NITI Aayog paper talks about the regulatory proposition for Digital Banking License in India into three-phased approach:

Step 1. Introduce a restricted Digital Business bank license

The license comes up with its business values dimension and legal mechanics.

| Business Value Dimensions | Specific condition |

|---|---|

| Minimum paid-up capital | For the restricted phase, Digital Business banks may be required to bring in ₹ 20 crore of minimum paid-up capital. |

| Track record & Potential Applicant Pool | The license may require one or more controlling persons of the applicant entity to have an established track record in adjacent industries such as e-commerce, payments, and technology. |

| Equal Access to the Infrastructure Enablers |

It should have access to all the key infrastructure enablers in the Indian financial ecosystem, as traditional banks are. That includes access to: • Aadhar e-KYC / Credit Information Companies • UPI (NPCI) / Central Payment Systems (NEFT/ RTGS) • ATM schemes • Deposit Insurance & Credit Guarantee Corporation (DICGC) (against levy of appropriate premium as determined by the DICGC) • AA ecosystem |

| Technological Risk regulation |

Continuing compliance with industry-grade certifications like PCI-DSS and the attendant audits of the Digital Business Banks Similar provisions as in Current banking System |

| Products and services |

Subject to asset and deposit limits and other restrictions (including for example, number of customers), a Digital Business bank should be able to offer standard banking services in the restricted

phase.

• Loans / Current Account /business banking Services / fixed deposits to MSME businesses • Factoring / Distribution (Channel Partner) • Others specified in Section 6 of the BR Act |

Step 2: The applicant acquiring this restricted license (“Licensee”) enlists in the regulatory sandbox and commences operations as a Digital Business bank in the sandbox. The RBI and the applicant identify a set of metrics for which the Licensee will be progressively monitored. Without being exhaustive, such metrics could be around cost to acquire a customer, volume/value of credit disbursed to MSMEs, technological preparedness, compliance levels of the Licensee across prudential aspects, among other things.

Step 3: Contingent on satisfactory performance of the Licensee in the sandbox, the initial set of restrictions can be progressively relaxed to advance the Licensee to a Full Stack Digital Business bank license.

Front to back integration towards complete Business Agility which promoted smoother collaboration

Global examples

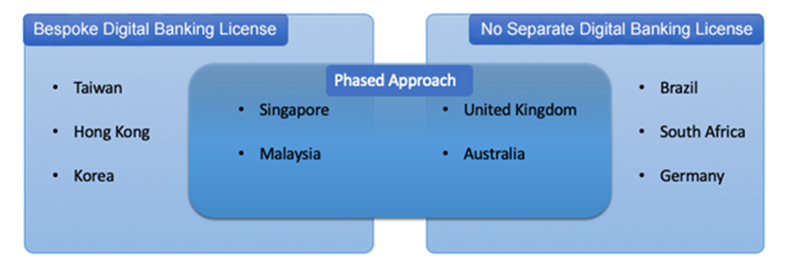

To lure new entrants and tech-first organisations to provide banking services which are cheap, customisable, and more focused on user experience, some regulators have adopted a bespoke digital banking license. Hong Kong , South Korea , Malaysia , Singapore , Taiwan and the Philippines are all examples of this approach. Bespoke digital banking licenses go by different names: “virtual banks” in Hong Kong, “internet-only banks” in Korea and Taiwan, “digital banks” in Singapore. By limiting physical touchpoints, regulators encourage innovation in digital distribution. Digital banks in Taiwan and Singapore are not allowed to establish branches. Bank Negara Malaysia proposes a similar measure. However, banks may participate in a shared ATM network and offer services through agents to ensure access by the underserved. New digital banks still must comply with basic regulatory requirements such as AML/CFT and consumer protection rules, risk management, and prudential requirements like minimum capital. Regulators expect new entrants to target unserved and underserved customer segments, including micro, small and medium enterprises. To attract (or yield to) big tech companies and other types of investors in digital banking, regulators are relaxing ownership limits where they exist. For instance, Korea allows non-financial companies to own up to 34 per cent of digital banks. The Financial Supervisory Commission in Taiwan allows a non-financial company with financial technology, e-commerce, or telecommunication capabilities to found a digital bank and own more than 10 per cent of the capital.

Creating a bespoke license is certainly not the only approach regulators have used to bring new players to the market. Australia, the United Kingdom, Singapore, and Switzerland are testing a phased licensing process whereby new entrants commence operations with limited activities before becoming fully licensed banks. The sequenced licensing allows applicants to launch their business at a small scale, subject to restrictions (for example, limits placed on the total amount of deposits the start-up bank can collect from the public at the initial stage). As they build their capabilities and capital readiness over a determined timeframe, regulatory approvals are expanded to a full-fledged license.

Without creating any specific licensing procedures and often relying on risk-based regulation, regulators in Brazil, Germany, and South Africa have licensed digital banks under their existing licensing regimes. It may attract less attention in news, but this approach seems to yield satisfactory results. These countries and their start-up digital banks are evidence that a special licensing category for digital banks often is not needed to create a digital banking industry

Pathway to Future

Technological innovation has been changing the banking landscape around the world. The COVID-19 pandemic will further push banking onto digital channels. Eventually, the distinction between "traditional" and "digital" banking will most likely fade away. The question is whether the regulatory framework will need to undergo significant changes on the way as proposed by the recent NITI Aayog paper. Also, the phased approach is welcomed and adopted in the Account Aggregator world as well. However, a regulatory push to support the licensed entities is required to fit them in the existing world of Banking.

Links:

https://www.niti.gov.in/sites/default/files/2021-11/Digital-Bank-A-Proposal-for-Licensing-and-Regulatory-Regime-for-India.24.11_0.pdf