Importance of Agile in Fintechs

- Mihir Rao, Manager (Agile Coach), Technology Consulting, Ernst & Young LLP

What is the first thing that comes to mind when we hear the names like Razorpay, Paytm, Policybazaar, Zest money, Robinhood, Stripe, Finastra?

Yes, these are the few of the topmost Fintechs across India & the world.

Ever wondered why only a handful of these companies succeeds & hundreds of them fail to sustain the ever-increasing market demand & competition?

The answer is - Business Agility

When it comes to the fintech industry, lean and agile principles have helped mould the industry into what it is today. In years gone by, financial organisations would embark on large development projects which would require months, and sometimes even years, to complete from start to finish. However, the development of lean and agile principles has enabled the fintech industry to dramatically increase the rate at which technology is adopted by businesses that operate within the industry. For example, organisations that have already been embracing agile software development for several years have seen a significant decrease in the time taken to market for technology adoption and new features. As a result of this, the fintech industry has pushed the envelope and evolved rapidly

As a result of the Covid-19 pandemic, collaboration tools and remote working have been adopted by organisations throughout the world. This will cause an even greater need for agility across businesses, not just when it comes to pure development purposes.

Although adopting new business models is a challenging process, organisations within the fintech industry should not hesitate to implement lean and agile models and systems. Companies risk being left behind by their competitors if they fail to adapt quickly enough. As such, it is only a matter of time before legacy systems fall away and become entirely obsolete.

Banks and financial institutions that wish to compete with truly agile organisations all face the same question: Can we become agile enough, fast enough? How to address the missing links & bridge the gaps?

Here are some ways to do that:

1. Cross-Functional Collaboration & flat organisations

Agile won’t work without a unity of purpose, a one-team, One Goal approach.

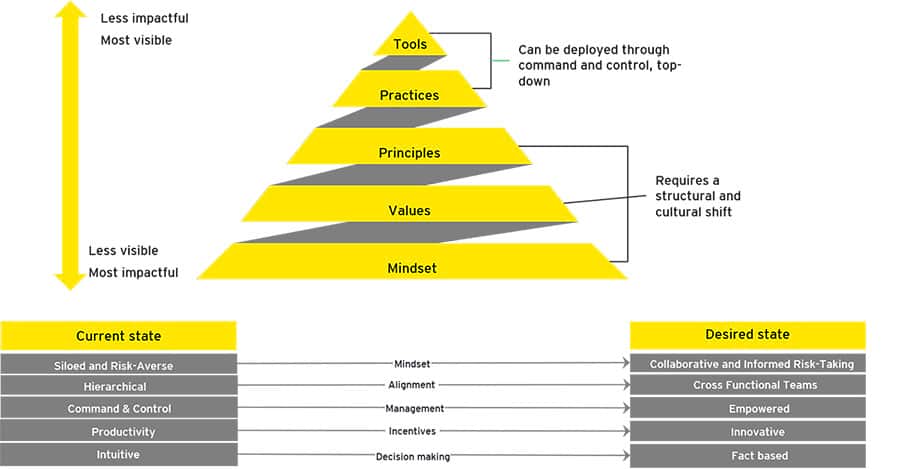

Becoming an agile organisation calls for a transformation that engages people, systems, and processes at all levels. Agile is not just about creating software, Agile mindset has to be adopted at all levels.

2. Empowered Teams & DevOps adoption:

Self-organising teams staffed with people from all relevant functions are the heart of an agile organisation. They, not their superiors, must be allowed to decide what they can deliver—in weeks, not months—based on the resources they have.

A company’s technology foundation also is critical to optimising agile teams. Leading practitioners of agile methodologies adopt DevOps strategies that automatically release new features after the team develops them. DevOps empowers a company to collect timely feedback from customers about new digital products. That feedback enables teams to quickly improve the product, the customer experience, or both.

3. Building the right team & Scaling

Agile teams must possess all the required skills for assessing customer needs and developing new products and product features. As such team members must include representatives from all functions that impact the customer experience i.e., marketing, sales, finance, HR, IT, research, operations, and other groups.

Success factors for such teams:

a. Feature-based teams

b. Training & Development of individuals & cross-skilling - based on product demand

c. Demand-based scaling of Agile teams

d. Reusable components/features/products & loosely coupled architecture / design (NOT monolithic) for higher scalability & maintainability

Adopting Agile methods is not the only solution, Integration of Business & IT teams & identifying critical factors mentioned below to succeed in agile adoption is the key here:

1. Iterative, Fail Fast-Succeed early, Collaborative and adaptive ways of working

2. Business and Product Development Team Come together

3. Cultivating culture to empower teams

4. Product Verticals

Some other factors also include:

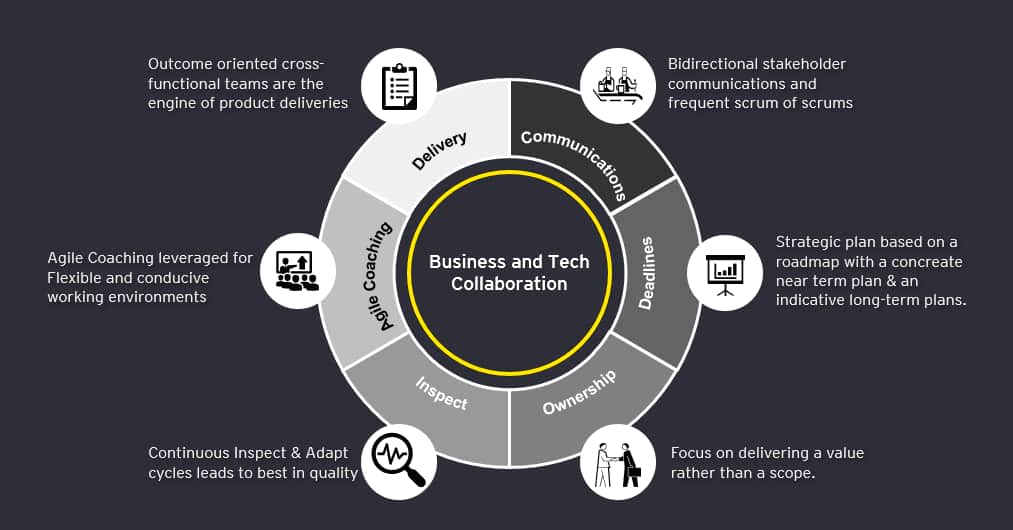

Building a robust Agile Ecosystem for Business & Tech collaboration:

6 factors that contribute to Smooth Business & Tech collaboration

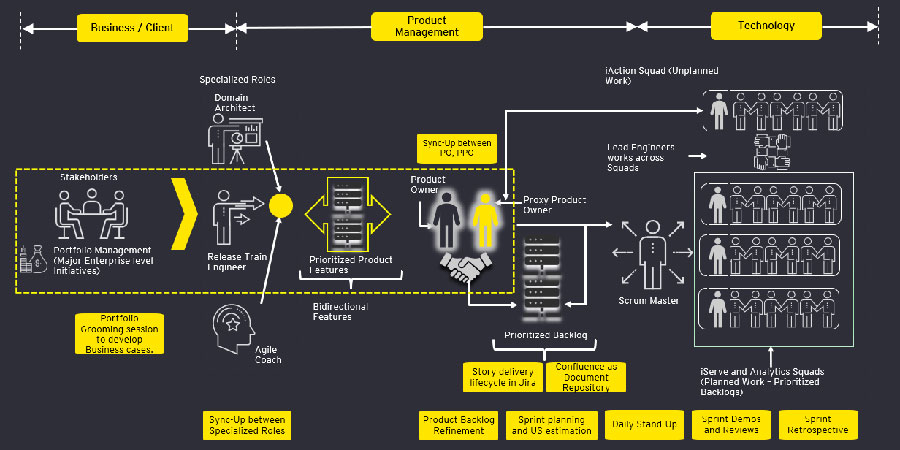

Front to Back Integration of Teams:

Front to back integration towards complete Business Agility which promoted smoother collaboration

To conclude, there are likely to be some in the organisation who resist the effort to move to agile. To bring detractors on board, leaders can implement a comprehensive change management strategy—building awareness, cultivating participants’ acceptance, and enabling them to understand the benefits.

Once these barriers are overcome, it should become obvious that the adoption of agile is making the organisation stronger.

FinTechs with agile cultures introduce new products and services much faster. They also are quicker at identifying and making cost reductions. Customer ratings also improve.

“There is plenty of ‘good’ out there, it’s those that can deliver ‘good’ FAST that win!” - Jeff Sutherland, Co-Creator of the Scrum framework