RBI shortlisted 6 innovative payments solutions as participant of its regulatory sandbox

To aid innovation of new financial products, Reserve Bank of India (RBI) came up with guidelines for a regulatory sandbox. It invited fintech companies to be part of it and test their new products. A regulatory sandbox allows companies to live test new products in a controlled environment. Regulators can see the entire process and decide on what to allow and what not to and a product's viability.

As a bank we are actively participating (along with tech start-ups) in the regulatory sandbox initiative, which is a protected environment within which the selected companies can create and test new innovative use cases in the Retail Payments space. With the current state of Retail payment transactions internet connectivity plays a very important role in completion of retail payment transactions.

RBI Regulatory sandbox will help banks and start-ups innovate in the space of Offline payments, Feature phone-based payments, IVR based payments and Contactless transactions, which can push digital transactions in areas where internet connectivity is weak or absent.

As a bank we are supporting start-ups selected by RBI in first Cohort to innovate in the space of Offline Payments, Feature phone-based payments and IVR based payments.

- Mr. Mehul Mistry, Head –Payments & Fintech Partnerships, IDFC First Bank

Outlook 2021: 5 trends that will shape the fintech sector in a 'path-breaking year'

COVID-19 was a tailwind for the fintech sector in 2020, with start-ups seeing unprecedented growth in users and transaction volumes. 2021 is expected to be another great year for the sector, but with more innovation in play. India’s fintech revolution heralded a new age of banking for the country’s more than 63 million businesses and 190 million unbanked adults who had been on the fringes of financial services for most - if not all - of their lifetimes.

Collaboration Is the New Competition in FinTech

Nearly every industry had to pivot, in multiple ways, to adapt to the challenges brought on by 2020. FinTech has been one of the most impacted, with people working, shopping, and banking from home due to social distancing.

Fintech Start-ups are enabling Financial Services Access by Stepping Up

Where there is a will, there is always a way. To deliver financial access to the neediest, fintech start-ups are using a bevy of ways like tapping the retail network spread far and wide across the country, 'sachet' approach to target even the lowest layer of the bottom-of-the-pyramid, and hand-crafting customized financial needs of the economically underprivileged.

Central bankers comb for crypto clues as Bahamas launches 'Sand Dollar

They are wary of a blockchain-based technology like bitcoin conceived to banish central banks, but reluctant to miss the boat on a potential game-changer and cede the field to Big Tech offerings like the Facebook-backed Diem, formerly Libra. Smaller nations such as Cambodia have also, meanwhile, forged ahead with their own projects in digital currencies, which promise to extend financial services to people currently lacking access to banking, especially in the developing world. The Bahamian scheme offers clues for other economies on how central bank digital currencies (CBDCs) can be introduced and work in practice - from getting users on board to helping businesses avoid costly payments fees.

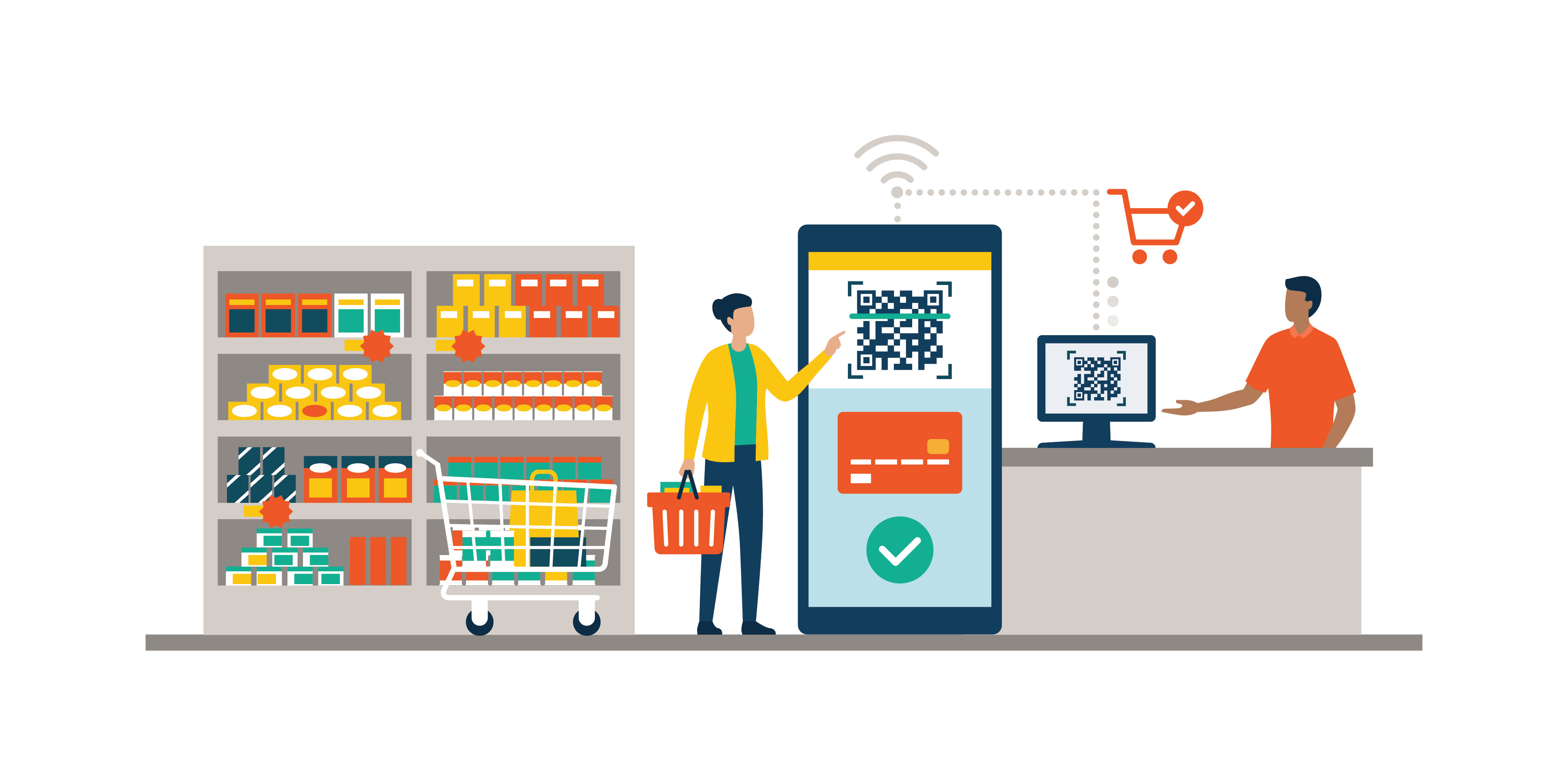

Reserve Bank of India’s Report of the Committee on the Analysis of QR (Quick Response) Code

Post demonetization, the acceptance infrastructure for QR codes has seen tremendous growth. As a result, QR based payments are rapidly increasing. One can simply scan a QR code to pay utility bills, fuel, grocery, food, travel, and several other categories. The acceptance infrastructure is a key element for the overall development of digital payments in India.

The QR Code is type of a two-dimensional bar code. It consists of black squares arranged in a square grid on a white background. Imaging devices such as smartphone cameras can be used to read and interpret these codes. A QR code that cannot change and is mostly printed on paper is referred to as a static QR code. It contains information about the payee, and the consumer must enter the amount after scanning. On the other hand, a dynamic QR code, is generated by software and can include additional fields such as the amount etc.

The report has come up with recommendations in 4 areas –Interoperability and Scalability, Innovation in terms of standardisation of Applications, Offline QR code etc. , Security and Customer education and awareness.